Hello Visitor! Log In

Hedging Planetary Risks: ‘From Weapons of Mass Destruction to Tools of Massive Social and Ecological Innovation’

ARTICLE | June 25, 2021 | BY Stefan Brunnhuber, Mariana Bozesan, Jeffrey Golden, Garry Jacobs, Phoebe Koundouri

Author(s)

Stefan Brunnhuber

Mariana Bozesan

Jeffrey Golden

Garry Jacobs

Phoebe Koundouri

A first systematization of new financial engineering that can hedge unchecked risks, enable unmet needs and finance our future.

Abstract

Cost analyses and risk assessments in the Anthropocene era need to differ from those of the past. Future developments now are determined by opportunity costs and planetary risks. We provide a first comprehensive systematization that can serve as a template for blended finance and blended securitization in order to finance our global commons. We show that financing our future requires multiple new financial engineering techniques that build upon the experiences of the private sector, but need to be adapted to meet the criteria of force majeure and planetary risks.

1. Introduction

It is already five past twelve. We could have had it cheaper. But now, the risks associated with our wealth standards are rising every month as we hesitate and wait. This is because we are now living in the Anthropocene era,1 meaning we are living in a world where everything is connected with everything and where we have to operate within planetary boundaries. And this is changing almost everything—the way we conduct business and educate our children, the way we do politics, build houses and feed ourselves, the way we organise our transport system, our power grid and our monetary system, and our impact on ecosystems. In consequence, this also fundamentally changes the way we need to evaluate and hedge the risks associated with all these projects. And this requires new and adjusted risk assessments and new financial engineering to shift from a high-carbon, high-efficiency monoculture-based society to a low-carbon, highly resilient and highly biodiverse society.2

Yet financing our future is a wicked problem. The public sector is over-indebted. Over 15 trillion USD in state bonds are providing negative yields, more than 40% of corporate bonds are issued with negative interest rates (2020), private cash deposits of over 12 trillion USD remain unproductive, and institutional investors are sitting on a carbon bubble exceeding 40 trillion USD, forcing them to write off substantial parts of their assets.

In this context, the UN Sustainable Development Goals (SDGs) can be considered the largest preventive program humans have ever engaged in. This program involves unfulfilled planetary opportunities (jobs, education, wellbeing and welfare) and unchecked risks (rising sea levels, loss of biodiversity, hurricanes, forced migration, unemployment). If we leave these opportunities unfulfilled, we create tremendous so-called opportunity costs: costs that arise from projects we failed to implement. And refusing to put a price tag on the risks associated with all these opportunities and leaving them unchecked does not mean they will disappear. Instead, the bill will have to be covered by the next generation, the Global South, the taxpayer or nature in general. In any case, it will be expensive.

Currently, our opportunities and risks are driven by finance. If no money is available, opportunities such as new jobs, technological innovation, health care for all, infrastructure programs and education are simply not met. The same is true for risk assessment. If there is no money available, corporates will not invest in an unsafe environment and will reduce their commitment to searching for new drugs for cancer or infectious diseases, and governmental bodies will avoid setting up the right policy for infrastructure programs.3 So, while finance currently drives opportunities and risks, it should actually be the other way round: unfulfilled opportunities and unchecked risks should drive finance to explore the most ambitious, elaborate, innovative and advanced financial engineering possible to satisfy both opportunities and risks at the same time.

In fact, any transformation is associated with risks. Risks have a price, and that price is best generated within a free and rule-based market. The agents of the financial sector have a lot of experience and data to hedge short-term risk in the range of 3-6 months, but little expertise and data in managing, foreseeing and pricing in long-term risks, especially those associated with the so-called ‘triple crisis’, which includes climate change, pandemics and the loss of biodiversity.*

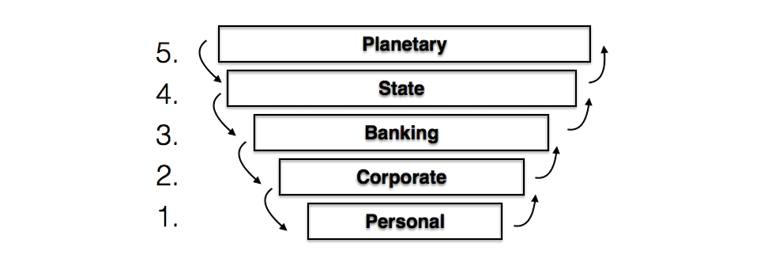

2. We like Rewards but not the Risks

A risk is a potential adverse event that disrupts our daily routine. It is a potential loss associated with doing or not doing something. Despite the fact that there is no zero-risk world and all risks are intertwined, from a financial perspective, we should differentiate between five categories of risk: 1) private householder (e.g.: housing insurance in a flood zone or health insurance); 2) corporates (project risk exposure, credit risk); 3) banking (credit default); 4) systemic (state deficit, collateral damage risks); 5) planetary (e.g.: global warming, losses in biodiversity and species and force majeure). Such a risk pyramid (see below) allows us to further differentiate between private and public risks, which are expressed in different legal codes. Whereas private assets and their associated risks (1-3) should be managed under private law, public assets and their associated risks (4-5) should be run under a public law regime. This entails completely different forms of financial securitization, depending on whether we are dealing with a private asset or a common good.†

Such planetary risks themselves are manifold by their very nature: they (a) affect everybody (b) affect in an asymmetric way, (c) cannot be covered by privates, corporates, commercial banks and single states only, (d) are interlinked with other subordinated risks (1-4), (e) have a non-linear, fat-tail component, (f) manifest as force majeure (earthquakes, war) short-term and as a triple crisis (global warming, loss of biodiversity and pandemics) long-term, and (g) finally, come on top of all the well-known general risks that each society has to bear (unemployment, health crises, bankruptcy or failed states). In short, the bill for the transition to a sustainable way of living that achieves the SDGs is substantially higher than anything we have calculated for in the past. If the financial instruments for coping with planetary risks remain unchecked, unstructured or unregulated, they turn into weapons of mass destruction (W. Buffett). But if they are structured in the right way, they turn into tools of massive social and environmental innovation, realizing unfulfilled opportunities. In short, they can magnify the losses or the wins, depending on how they are structured.

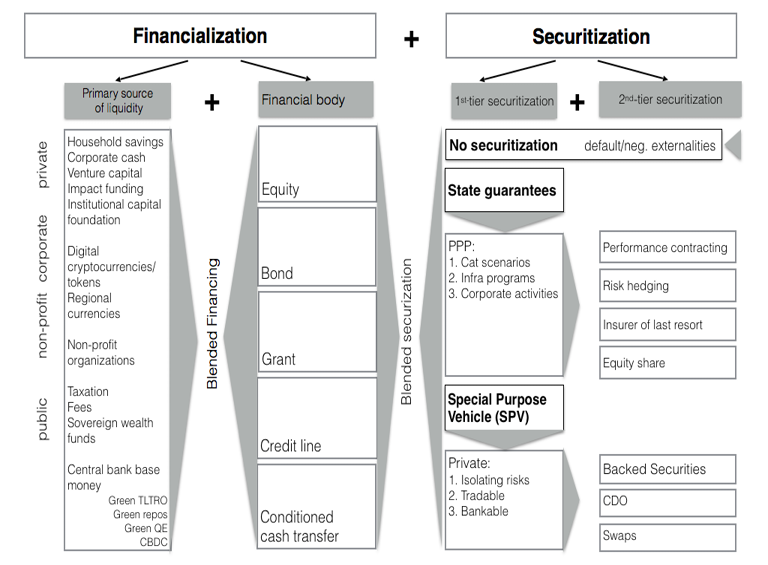

3. A Two-tier Approach. Financialization and Securitization

From a financial perspective, the shift from a high-carbon, low-biodiversity and quite monopolized economy towards a low-carbon, high-diversity and more decentralized economy requires a two-tier approach. First, we have to identify the source and the primary financial body, both referred to as financialization. The source includes private, profit, non-profit and public resources. The assets that allow us to finance the projects mainly include private equity funds, bonds (loans), facilities, unstructured credit lines, grants and direct cash transfer systems. Both—the source and the primary body—represent what is called blended financing.

Second, besides financialization, we need additional financial assets that cover the risks associated with the projects involved, called securitization.4 As no project is risk free, different forms of securitization are crucial to getting the initial projects off the ground. The options for securitization are threefold themselves. First, we can reject any form of securitization. In the case of a default, the agent will go bankrupt and/or it will generate massive social and environmental externalities, which will have to be paid for by a third party. The second option is public or state guarantees, which build up confidence in immature markets, accelerate implementation and safeguard the program’s credibility.‡ In this case, the state acts as an insurer and has to price in risks and charge for its compensation. Such PPPs (private-public partnerships) involve either catastrophic scenarios (Cat) such as droughts, flooding, and hunger epidemics; infrastructure projects (Infra), such as public sewage, the water supply, energy grid, and investment into the healthcare or educational systems; or public involvement in corporate activities (Cor) in adverse, immature or volatile environments. Such PPPs entail three additional specifications: (1) forms of performance contracting, which clarify ownership and specific management activities (delivery, building, managing); (2) risk-hedging instruments, which include asset-backed securities (ABS), credit default obligations (CDO) and swaps following pre-agreed key indicators (see below); (3) defined equity shares of private-sector involvement. Besides these state guarantees, as a third securitization option we can identify so-called private special purpose vehicles (SPV), which make it possible to isolate and trade these risks separately.§ They could be used by private or public entities, but remain bankable and tradable. SPVs involve backed securities, different forms of specific derivatives, credit default obligations (CDO) and a small number of more specific swaps. In particular, they mobilise and channel private capital, increase market efficiency and allow price discovery and transparency to hedge these risks. Most such financial engineering is standardized to allow for cross-sectional comparison, or consists of customized over-the-counter (OTC) products that make it possible to provide individual solutions for market participants. In either case, they represent market-based solutions to better hedge risks and enable opportunities. These differentiations are key in order to address the different nature of risks, depending on whether they are public or private. All these instruments together are called blended securitization. We claim that it is particularly important to consider market-oriented financial assets, as it is often cheaper and more accurate to isolate and hedge risks through these assets than to finance these risks through taxpayers’ money in public debt schemes.5

"A special-purpose parallel digital currency run through distributive ledger technology (DLT), accepted as legal tender to pay taxes and wages, convertible into traditional currency, and issued by central banks (CBDCs) or regulated private agents (cryptocurrencies) could meet the requirements and complexities of the Anthropocene Era."

Despite the great variety and complexity of financial engineering, all these financial instruments (financialization and securitization) at the core follow a three-part rationale:

- they allow better hedging of the risks associated with interest rates, currency, and specific projects in the transition towards better environmental, social and corporate governance (ESG), including covering short-term volatility and allowing long-term funding and perspectives.

- They make it possible to manage counterpart payments to compensate for the non-achievement of pre-agreed targets, which results in a net-zero-sum game.

- They support and clarify legal coding and contracting on which party (private to private or private to public) owns the asset and the liabilities and ultimately carries the risk. And any structured financial asset involves such a two-tier approach: financing the project and securitizing the risks of that project.¶

Table 1 below provides a first comprehensive systematization—either OTC, customized, standardized or regulated—which can cover most (if not all) financial tools required to finance unmet needs and unchecked risks at the same time. In fact, it provides a general template for financing our commons. We start by using the current financial contracts in operation and adapt them to the requirements of a more complex, interconnected world, where financing our commons becomes key. Taken together, this blended financialization-securitization schema provides a guideline for private and public sector engagement in a multi-tier approach, where we differentiate between the source of finance (‘Where does the money come from?’), the primary financial body (‘Which asset?’), and first- and second-tier securitizations (‘Is the project hedged and who is deleveraging it?’). The following table summarizes this systematization. The associated legend specifies the required instruments in greater detail.

Table 1: A Comprehensive Systematization of Structured Financial Products

required to Finance our Future

Legend to the table above: further specifications and explanations of the structured financial assets to meet unmet needs and manage unchecked risks.

Table 2: New financial engineering to meet unmet needs and manage unchecked risks.

|

A. Financialization |

1st Tier |

2nd Tier |

Explanation |

|

I. Primary source of liquidity |

Where does the money come from? Private/corporate profit/non-profit/public sources TO NOTE: Digital currencies/central bank base money could add additional targeted liquidity to the entire financial schema and completely change the risk assessment.i |

||

|

II. Primary financial body |

Each of the five bodies allows for further differentiation into social (S), social impact (SI), transition (T), green (G) or green impact (GI). TO NOTE: The financial assets have specific conditions attached.ii |

||

|

B. Securitization |

1st Tier |

2nd Tier |

Explanation |

|

I. No |

|

The initial contract does not involve any risk hedging. In the case of a default, there will be social/ecological externalities which have to be covered by a third party and/or the agent has to file for bankruptcy. |

|

|

II. State |

Allow specific public-private partnerships (PPP). Three categories (A-C) are feasible, which entail a different risk profile accordingly. |

||

|

A. Cat |

Refer to entailed catastrophic risks.iii |

||

|

B. Infra |

Refer to infrastructure programs such as health care, education or energy.iv |

||

|

C. Corporate activity |

Refers to private corporate activities in an adverse/insecure environment |

||

|

Performance contracting |

Refers to public-sector ownership and private-sector management.v |

||

|

Equity share |

Applies to tradable/bankable SPVs (see below) used by public bodies to isolate the risks and cover their expenses. |

||

|

Risk hedging |

The state covers the entire risk or parts of the risks associated with the project. |

||

|

III. Special Purpose Vehicle (SPV) |

Refers to tradable and bankable risk instruments to hedge private or public assets. |

||

|

A. Backed Securities |

Mainly so-called asset-backed securities (ABS) or mortgage-backed securities (MBS). |

||

|

B. CDOs |

Future losses are hedged following the occurrence of a pre-agreed catastrophic event or social development. Enables the bearer of risks to obtain protection from losses or non-achievement without increasing their debt, transferring the risk to the capital market.vi |

||

|

C. Swaps |

Pre-agreed key indicators (like interest rate, currency volatility, debt ratio, high carbon equity or the abandoning of fossil units (exit)) determine the nominal volume to swap into pre-agreed low carbon projects (reforestation, natural reserve) or providing a way to isolate the risk, making it tradable and bankable. vii |

- This includes green targeted long-term refinancing operations (TLTRO): conditioned lending for banks, SMEs, private households and public-sector entities to finance green investment and consumption. Green repurchase agreements (repos): green assets are eligible as collateral for borrowing liquidity from central banks. They serve as collateral for financial institutions for short-term refinancing and operate as criteria in case of a haircut. Green QE: additional base money is issued for developing banks, which operate as financial intermediaries for conditioned green lending. Central bank digital currencies (CBDC): digital central bank money issued directly or indirectly to finance and hedge projects aiming to ensure our common future (SDGs).

- Social (S) facility: pre-agreed investment (like affordable basic infrastructure, access to essential services, affordable housing or food security). Social impact facility (SI): a government enters into an agreement with an NGO or a non-profit organization, paying for a pre-agreed social outcome. Transition (T) facility: allowing the brown, high-carbon economy to transition towards low-carbon manufacturing. Green (G) facility: the holder guarantees one of the four following outcomes: climate change mitigation, climate change adaptation, nature resource conservation, biodiversity or pollution prevention. Green impact (GI) facility: the holder of the title ensures specific outcomes, like setting up a nature reserve or reforesting an area following pre-agreed key indicators.

- Further specifications: a harvest default facility (HAD) would allow payments according to pre-agreed key parameters, like days of extreme drought; a pandemic emergency facility (PEF) would create liquidity for anybody affected by a virus pandemic, e.g. following lab testing; a flood and heat facility (FaH) would trigger additional flow of capital to the insured person/corporate according to a pre-agreed number of days of heat or a sea level rise. A forced migration facility (FMF) would operate in the same way. A closer look at HAD reveals that two-thirds of global farming are small enterprises operating for self-sufficiency. Once a drought occurs, HADs come into play. However, it is unnecessary to loan money from the private sector and reimburse the farmers with a risk premium. A supplemental digital currency, operating through a non-profit cooperative banking sector and monitored by the UN, could take over this task with less risk and higher yields for the community. In each case, the bank’s balance sheets increase in the first place. In the case of a harvest default, the bank will need to write the event off and decreases its balance sheets in the second place, but millions of farmers are saved from insolvency and can continue their business. In the case of such force majeure, alternative public funding is cheaper than involving the private sector.

- Like building a hospital, a power grid, or investing in an R&D program to cure cancer or develop a vaccine against a virus, or applied research to find new drugs to overcome antibiotic resistance. Here, the private and the public sector collaborate in two ways. The public sector provides de-risking in the case of failure and/or provides an advanced commitment strategy (ACS), where a state body guarantees it will buy a certain quantity of drugs in case of success.

- Including the building, service delivery, maintenance and management of the project, following specific pre-agreed key indicators. For commons, ownership should remain public, management could be provided by a private entity.

- In these contracts, pre-agreed key indicators (like rates of unemployment or pre-schooling, number of hurricanes, heat days or precipitation, tons of CO2 etc.) determine the premium paid and make the asset tradable and bankable. Further specifications allow CDO-S (social), CDO-E (environmental), CDO-D (disaster) and CDO-CaT (cap and trade). To note: the market for securitization is about 100 times larger than the conventional insurance industry, providing a huge amount of liquidity to hedge these risks.

- Mainly IRS (interest rate swaps) and CCS (cross-currency swaps) to lower the risk associated with interest and currency volatility, like hedging micro-finance loans in local currencies. In addition, there should be a DNS (debt-to-nature swap), an ES (equity swap) and so-called EES (ex-equity swaps), where a traditional loan or equity comes with the condition that it be converted into a more sustainable asset, including ending and exiting the initial business activity (ex-swap).

“The power of structured financial engineering is that, if done the right way, it converts these weapons of mass destruction into tools of massive (social and environmental) innovation.”

4. Emerging from Emergency: We need to think differently

In fact, we can use (most of) the financial engineering instruments already in use as tools for wise inventions to create wealth and prevent them from becoming weapons of mass destruction. If we apply the risk pyramid above, the increase of risk categories 4 and 5 would require additional liquidity to be made available. Central bank base money (CBDC, green QE) as public-sector involvement or private digital currencies or tokens would meet this risk gap.**

To be more specific: we can build upon these refined financial assets and experiences above, but augment and adjust them to the requirements of the complexity of the Anthropocene era. A special-purpose parallel digital currency run through distributive ledger technology (DLT), accepted as legal tender to pay taxes and wages, convertible into traditional currency, and issued by central banks (CBDCs) or regulated private agents (cryptocurrencies) could meet the requirements and complexities of the Anthropocene Era.”. This additional liquidity/purchasing power in most cases would operate as an additional financial facility, not as a loan, and allow us to non-disruptively hedge/fund/transition our society towards a more sustainable future, where welfare losses are minimized, wellbeing is maximized and moral hazard is reduced.††

The financial and monetary policy should reflect and mirror the requirements of the real economy. Finance has a service function, not a purpose of its own."

From this differential risk assessment perspective, it is irrational, costly and inefficient to use only taxpayers’ money or private debt obligations to finance risk-adjusted projects which are exposed to planetary risks (force majeure or triple crisis).6 This would either lead to a private gambling or best educated guess scenario, where the private sector simply bets on the future, which creates a zero-sum game. Or it would lead to unlimited public debts to the private sector, restricting current and future generations in their political choices. Clearly, there are better options.

Applying the entire spectrum of financial engineering as explained in this text would finally create a no-regret approach to tackle the planetary risks mentioned above. In fact, the systematization provides almost unlimited permutations, as most of the financial facilities could be backed up by development banks, funded by central banks, monitored by the UN and enabled through domestic and national agencies. If we are prepared to change our mindset and the underlying narrative about money, unlimited options suddenly are possible.

5. Conclusion

Traditional fiscal and monetary policy favours private assets and capital accumulation through private law. In this legal framework, commons are considered second best. If we want commons to unleash their full potential, we should manage them through public law, not private law, and adapt accordingly.

The power of structured financial engineering is that, if done the right way, it converts these weapons of mass destruction into tools of massive (social and environmental) innovation. If we want a more cyclical economy, higher ESG standards and fewer social and ecological externalities, none of these will happen automatically through pure will or self-commitment, but instead require a legal financial framework to make them possible and cover the associated liabilities. In short, the financial and monetary policy should reflect and mirror the requirements of the real economy. Finance has a service function, not a purpose of its own. This will lead the way towards a monetary ecosystem that better mirrors the physical ecosystem under pressure and alters the assessment of risk.

Some crises will be inevitable; others might be completely avoidable. In each case, finance can be a significant help in adapting to minimize such planetary risks. Whether we end up with the madness of the mob or the wisdom of the swarm depends on the financial environment we are operating in. In a world where everything is interconnected, the opportunity costs of unmet needs and unchecked risks are higher and cannot be managed by either the private or the public sector alone. In other words, whereas risks can be quantified and hedged, systemic uncertainties cannot; they require a different policy. If we then start identifying planetary risks, fund and hedge them properly, differentiate them from uncertainties and cover them through public bodies respectively, moral hazard will finally turn into unlimited opportunities, beyond chance and necessity. And this is then the moment we have all been waiting for—the moment when these opportunities will drive finance and not the other way around.

References

- Brown, E. Public Banking Institute

- Brunnhuber, S. (2021). Financing our Future (in press) https://www.amazon.de/Financing-our-Future-Unveiling-Parallel/dp/3030648257

- Brunnhuber, S. and Jacobs, G. (2020). “Innovative Financial Engineering to Fund the SDGs: A WAAS Initiative.” Cadmus 4, no.2: 141–148. http://cadmusjournal.org/article/volume-4/issue-2-part-2/innovative-financialengineering-fund-sdgs-waas-initiative

- Chenet, H., Collins, JR., Lerven, Fv (2021). Finance, climate-change and radical uncertainty: Towards a precautionary approach to financial policy. Ecological Economics 183 (2021) 106957

- Crutzen, P. (2002). “Geology of mankind.” Nature 415: 23.

- Derivatives in Sustainable Finance, Centre for European Policy Studies (CEPS) and the European Capital Markets Institute (ECMI) https://www.isda.org/a/KOmTE/Derivatives-in-Sustainable-Finance.pdf

- ISDA (2021) https://www.isda.org/2021/01/11/overview-of-esg-related-derivatives-products-and-transactions/?_zs=eHpp81&_zl=q0i76

- Lo, A. (2017). Adaptive Markets: Financial Evolution at the Speed of Thought. Princeton: Princeton University Press.

- Mazzucato, M. (2017). The Value of Everything. London: Penguin.

- Petrou, K. (2021). Engine of Inequality: The Fed and the Future of Wealth in America, Wiley

- Pistor, K. (2019). The Code of Capital - How the Law Creates Wealth and Inequality. Princeton: Princeton University Press.

- Wray, L. R. (2015). Modern Money Theory: A Primer on Macroeconomics for Sovereign Monetary Systems. London: Palgrave Macmillan, pp. 137–141, 199–206.

Notes

- P Crutzen, “Geology of mankind,” Nature 415, no. 23 (2002), 23.

- H Chenet, JR Collins,, Fv Lerven “Finance, climate-change and radical uncertainty: Towards a precautionary approach to financial policy,” Ecological Economics 183 (2021)

- Mariana Mazzucato, The Value of Everything (London: Penguin, 2017)

- Andrew Lo, A, Adaptive Markets: Financial Evolution at the Speed of Thought (Princeton: Princeton University Press, 2017)

- L. Randall Wray, Modern Money Theory: A Primer on Macroeconomics for Sovereign Monetary Systems (London: Palgrave Macmillan, 2015) pp. 137–141, 199–206.

- Stefan Brunnhuber and Garry Jacobs, “Innovative Financial Engineering to Fund the SDGs: A WAAS Initiative,” Cadmus 4, no. 2 (2020): 141–148 http://cadmusjournal.org/article/volume-4/issue-2-part-2/innovative-financialengineering-fund-sdgs-waas-initiative

* In the Anthropocene era, accounting and project financing need to follow a different calculation. Traditionally, we have isolated and externalized risks and then referred to historical costs, sunk costs, future costs, replacement costs, direct and indirect costs, fixed and variable costs, marginal costs and so forth. However, the major costs in the Anthropocene era are so-called opportunity costs: the cost of choosing one and not another alternative. All other traditional forms of costs are subordinate. Opportunity costs here reflect the unfulfilled needs and unchecked risks of projects we have not realized because we decided to put our money somewhere else. This is particularly relevant because these costs do not disappear, but feed back onto our balance sheets as additional indirect, variable costs or the like. This means that opportunity costs are not only theoretical or hypothetical costs, but real costs. For example: we pay the price for clean water twice (once at the tap and once with our taxes, cleaning polluted water). We should therefore call these costs opportunity costs 2.0.

† We should be aware that in a fully interconnected world, we cannot simply hedge risks, by handing over the hot potato from one private agent to another, we need a public body that ensures some sort of a precautionary principle. see Pistor. K. (2019). The Code of Capital - How the Law Creates Wealth and Inequality. Princeton: Princeton University Press.

‡ Most such state guarantee programs follow the rationale of reducing the cost of capital for the private sector to address wider market instability, create new sources of funding, leverage additional finance, and finally get the asset built and the program done without managing or paying for it (!). In this sense, most state guarantee programs run as PPP (private-public partnerships) that transcend the given standard risk allocation, making projects bankable, creditworthy and tradable that otherwise would not be; see www.epec.org.

§ Derivatives in Sustainable Finance, Centre for European Policy Studies (CEPS) and the European Capital Markets Institute (ECMI): https://www.isda.org/a/KOmTE/Derivatives-in-Sustainable-Finance.pdf.

¶ ISDA (2021), cf. https://www.isda.org/2021/01/11/overview-of-esg-related-derivatives-products-and-transactions/?_zs=eHpp81&_zl=q0i76

** This is particularly true for planetary risks. Empirically, ESG standardization and hedging will leave the hot spots, where the money is needed most and fastest (low- and middle-income countries), untouched. And the net capital return from these poor regions to the rich regions on this planet exceeds ODA, FDI and remittance payments in total. This will leave the regions with the highest negative impact behind as net donors, which will finally increase the systemic risks for all of us (Brunnhuber 2021).

†† The debt/GDP ratio shows that most countries are over indebted, unable to finance the projects identified. A double entry book keeping procedure would finally correct and end this endless debate. It is important where the money goes. If it is invested in the right projects (SDGs), the ROI is positive. This can cut down the debt/GDP ratio by more than 50%. See E. Brown, president of the Public Banking Institute; or K. Petrou, who can provide intimate details in Engine of Inequality: The Fed and the Future of Wealth in America (2021).