Hello Visitor! Log In

The Evolution of Wealth & Human Security: The Paradox of Value and Uncertainty

ARTICLE | November 1, 2011 | BY Orio Giarini, Garry Jacobs

Author(s)

Orio Giarini

Garry Jacobs

Life evolves by consciousness, consciousness evolves by organization. Human life evolves by a progressive heightening of our awareness, expansion of our knowledge, widening of our attitudes, and elevation of our values. This evolving human consciousness progressively expresses itself through the formulation and creation of more complex and effective organization – a seamlessly integrated, organic web of relationships encompassing ideas, knowledge, people, activities, processes, systems, technology, laws, institutions, power and values – political, economic, social, cultural, intellectual and psychological. The capacities of one person acting on his own are limited, but the action of organization has no limit. Organization creates abundance.

The evolution of economy is an integral part of the wider evolution of human consciousness and social organization. The history of economics and economic thought reflect this process. Progressive advances in our collective capacity to generate wealth and promote human security are the results of this process. Our comprehension of the process has a profound bearing on the development of that capacity. Rightly perceived, we can discover the true relationship between scarcity and wealth, uncertainty and human security, and the means to transform one into the other. This requires a change in perspective, a shift in values from the quest for immutable, natural economic laws governing the blind pursuit of money and monetarized growth to a focus on the intrinsic value and creative potential of human beings in quest of ever-expanding security, welfare and well-being – the real wealth – that all humanity aspires for. It requires, too, the development of appropriate measures consistent with this shift in values and perspective. When growth focuses on people rather than things, the limits to growth give way to limitless growth.

1. The Rise of Uncertainty

Economics as a social discipline was founded at the end of the eighteenth century on the basis of Adam Smith’s Wealth of Nations. Writing at the dawn of the Industrial Revolution when agriculture was still perceived as the major determinant of wealth, Smith was a practicing moral philosopher, firmly committed to fighting poverty and generating prosperity, not only in his native Scotland but worldwide. He perceived the enormous power of social organization to generate wealth – the power of division, specialization of labor and technology to optimize efficiency and the power of markets and trade, both domestic and international, to incentivize producers and benefit consumers. A firm believer in freedom, he advocated free trade as more conducive to human welfare than mercantilist and monopolistic policies; but he would never have countenanced a world in which the sanctity of the market is given precedence over the well-being of human beings. He believed in freeing economic activity from the arbitrary will of feudal landlords, monarchs and parliaments, but equally so from the narrow self-interest of businesses which advocated policies beneficial to themselves while detrimental to society-at-large.

Born in an age steeped in Newtonian and Cartesian concepts of immutable natural laws and the clockwork certainty of physical nature, he based his concept of economic value on the equilibrium price between supply and demand resulting from unimpeded exchange of goods. That, he argued, was the best way to provide signals to producers where to invest their capital and what to produce and to ensure the lowest possible price to the consumer. Considering foreign wars and enforced colonization a tremendous waste of capital and human resources, which should be more properly invested for productive purposes, he would have firmly rejected the contemporary view that all economic growth is good growth. Yet theoretically he did not distinguish positive from negative contributions to national wealth. At a time when less than half of all economic activity occurred through monetary transactions, he perceived the catalytic role that money played in facilitating commercial exchange and promoting capital investment in manufacturing. But he was extremely skeptical of the efficacy of separating ownership from management and would have been appalled by modern financial markets which have divorced money from its primary role as a lubricant to production and trade in the real economy. An astute observer of fact with a keen historical perspective of social evolution, he drew lessons from the distant past applicable to the tumultuous times in which he lived and based his conclusions on experience rather than ideology. His contributions in thought were validated by the remarkable achievements of the Industrial Revolution, but most of what we now refer to as the service sector did not exist at the time and lay outside his field of consideration.

The world has radically changed since Smith’s days, but economics has remained strangely wedded to concepts which were brilliant insights in his time, but irrelevant, misplaced and even dangerous in our own. Smith would have been the first to acknowledge it. Early in the 20th century, the focus of economics shifted from the supply to the demand side of the trade equation, but the equation itself and the basis for valuing economic activity remained unquestioned. The reference to a price equilibrium justified the search for a system providing a higher and higher degree of certainty. It was deterministic, linked to a frozen definition in time and space. Uncertainty was thought to result from insufficient knowledge, a deficiency that could be overcome with time and eventually eliminated.

While economics clings to the static concepts of equilibrium and certainty, science has evolved over the past century towards an undeterministic view. It does not pretend to provide definitive (godlike) knowledge. Paradoxically, the more we know, the more we identify an increasing number of questions: understanding our ignorance is the first tool in the advancement of knowledge.

We now perceive that certainty is a rare exception rather than the rule. Rather than regarding that as a negative, we perceive that this uncertainty really represents an unlimited field of possibilities out of which we can seek to create positive value, as the insurance industry harnesses the uncertainty of individual events to create greater security for society as a whole. A mechanistic view of manufacturing will not serve in this age in which production volumes are enormous, time quite literally flies, needs change with lightning speed and all aspects of society – and increasingly of the whole world – have become integrated into a unified system, a living organism, that is undergoing a continuous process of rapid evolution.

The formulas of economics no longer suffice to reflect the inherent complexity and uncertainty of contemporary society. Our concept of economic time needs to change radically. In a traditional economy, time could be measured from the point at which production begins and ends with a sales transaction. In our contemporary real economy, time begins long before production or sale and extends long afterwards. Research commences years or even decades before a product is ready for market and fails to generate a marketable product more often than it succeeds. The uncertainty of that investment in research constitutes a major portion of the cost of products today.

Furthermore, we can no longer assess the cost and profit of a product or service at the precise time of delivery. The costs associated with product recalls, product liability, waste management and remediation may arise years after the sale. The delivery of many services extends over very long periods, as in the case of education, medical care and insurance, and cannot be valued in terms of discrete instantaneous transactions. Value resides in the sustained performance of a complex delivery system over time. Thus, the notion that economic value is created and can be measured at a finite point in time based on cost of production is outdated and needs to be replaced with a concept that takes into account the utilization value and utilization time with reference to the user. When utilization over time is taken into account, we rapidly discover that any hope to arrive at objective certainty (as in classical economic equilibrium) is unrealistic. Uncertainties and probabilities have become essential concepts for understanding and managing the wealth of nations. The key economic challenge today is to understand and manage risks, uncertainty and vulnerability.

As Smith understood the negative, wasteful contribution of military expenditure to national wealth, we now realize that this is only one instance of a much broader range of negative economic activities, negative in the sense that they destroy and deplete rather than augment wealth, welfare and well-being. When properly accounted for, depletion of non-renewable resources and pollution of the environment may wholly negate the beneficial effects of economic activities we once cherished with religious faith. The concept of sustainable development is based on the best use and preservation of resources, both human and material, taking into due account the notions of utilization in time and the issue of uncertainty. We need to redefine what we mean by and how we measure value as the basic reference point for the wealth and welfare of nations.

Extended monetarization of the economy was an essential component and consequence of the Industrial Revolution and the model of economic growth that has become prevalent worldwide. In recent times, it has been a common error to blithely assume that all growth contributes to human welfare. On the one hand, our per capita economic measures fail to take into account the dramatic increase in income and wealth inequality, concealing the fact that growth and rising national per capita can be associated with flat or falling living standards for large sections of the population. The numbers may indicate overall progress which reality does not reflect. The financial sector which caters disproportionately to the wealthy has been the fastest growing sector in recent decades. But do rising stock prices that boost the balance sheets of the super-rich really reflect a better life for the common man? On the other hand, monetary measures fail to reflect enormous improvements in quality of life as well as the extension of the monetary economy into activities that were previously carried out without monetary transactions.

The changes represented by uncertainty, utilization time, negative value and monetarization in economics represent quantum shifts in conception comparable in their significance to those brought about in physics by Einstein’s Theory of Relativity and Heisenberg’s Uncertainty principle. They compel us to re-examine economic thought at its very roots, to challenge once sacred beliefs and to fashion new economic theory and new measures appropriate to the economic conditions and social aspirations of humanity in the 21st Century.

When we do this, we may not arrive at greater certainty, but we most definitely do arrive at a greater awareness of the creative process and the enormous untapped potential, which are the other side of uncertainty and constitute a fundamental paradox of our existence. For, uncertainty begins to reveal itself as a field of infinite creative possibilities for the generation of wealth and the enhancement of human security.

2. In Quest of Certainty

Our conception of heaven is a world blessed with an unlimited and assured abundance of everything good. According to the Bible, Adam and Eve were expelled from the Garden of Eden and cast into a new economic world characterized by scarcity and uncertainty. They discovered a world on which Nature had bestowed a richly abundant physical and biological dowry and patrimony (D&P) of fresh air, pure water, minerals, fruit and nut-laden trees, edible and medicinal plants, animals for food and clothing, and many other riches, though not everywhere and not always in the desired quantity or quality.[*] Their descendants established human settlements on lakes and river basins where basic human needs could be most easily met by hunting and gathering. But as population expanded, Earth’s abundance proved less adequate and reliable.

After carefully observing the methods of Nature for millennium, the descendants of Adam and Eve acquired knowledge of some of her methods and even discovered ways to improve upon them. The birth of agriculture marked the first economic revolution in which human beings enhanced the natural productivity of their environment. They replaced the limitations and uncertainty of gathering Nature’s bounty with the greater abundance and security of producing their own food. Wandering tribes gave place to sedentary settlements organized around the seasonal food production cycle. To the natural and biological D&P with which the earth was endowed, human beings added to enhance their well-being a man-made cultural D&P. New facts were discovered, ideas conceived, tools fashioned, methods invented, skills developed, activities sub-divided and specialized, customs and social structures established. Thus, early humanity embarked on the path of development from ignorance to knowledge of Nature’s ways, from unstructured life in nature to the structured life of civilization, from the insecurity of dependence to the greater certainty of mastery.

The last ten millennia trace the most recent and dramatic steps in the process by which human beings acquired the knowledge to improve life on earth in quest of heavenly abundance and organized the activities of the society to translate that knowledge into practice. Through never-ending research and experimentation, they discovered new sources of energy as substitutes for wood, new varieties of food, new materials for building and crafting, new instruments and techniques with which to feed, clothe, house, hunt and war with one another. They subdivided the activities of the community into an increasing number of specialized tasks and occupations. They evolved an hierarchy of authority to ensure order, coordination and cooperation among their members. They created customs, rules, laws, systems to protect, standardize, regularize and harmonize. Each of these discoveries and inventions enhanced their capacity for survival amidst the unpredictable conditions imposed by nature.

3. Discovering the Wealth of Nations

Perhaps to their puzzlement, successive generations of our ancestors discovered that each marvellous achievement was eventually followed by new types of problems and new forms of uncertainty. Leaving the forest for the security of sedentary settlements, as their numbers grew so did their needs, creating new problems associated with larger, more complex societies. The human population grew from about 10 million in 8000 BC to a billion in 1800 AD, when Thomas Malthus forecast that that there would be insufficient resources to feed Europe’s growing population. His calculations were not wrong. As in the case of so many before and after him, his reasonable prediction was confounded by the unexpected. In this case it was the introduction of the potato from the New World. Scarcity and uncertainty were once again forestalled, but not eliminated, by new discovery emerging from the unknown.

In 1776 another keen observer and analyst, Adam Smith, published his famous treatise presenting theories that would become the foundation for economics as a specific discipline or science. At a time when French Physiocrats such as Francois Quesnay were insisting that agriculture is the principal source of national wealth, Smith had the foresight to perceive that the development of manufacturing would become a crucial weapon in the fight against scarcity.1 Published a year after James Watt patented his improved steam engine, which was soon to usher in the first Industrial Revolution, Smith perceived a wider formula for national wealth consisting of three major terms: division of labor, accumulation of capital and free markets. A new organization of work employing skilled workers and technology to perform specialized tasks manufacturing more products with less resources and at far lower cost than ever before was the basis.2 Watt’s steam engine provided the energy needed to propel a wide range of machinery and the mechanical impulse to produce the required movements.3 Smith also understood the importance of another form of D&P, monetarized D&P or Capital, as a unique social organization designed to increase the mobility of resources in time and space. Another social organization, Market, provided the maximum incentive to both agricultural and industrial producers to generate saleable surpluses rather than merely produce for self-consumption. At a time when only a tiny portion of produce entered the monetarized sector of the economy, Smith understood the increasingly important role of money and credit to promote trade.

But Smith’s conception did not end here. He was a political economist in the classical sense of the word, a branch of moral philosophy concerned with ethics and social justice. He viewed political economy as the science of a statesman or legislator whose twin objectives were to generate prosperity for the people, while also supplying the state with sufficient revenue for public services. His quest was not to discover the immutable natural laws of economics, for he understood that economy was a purely human invention. His goal was to comprehend the most effective policies to optimize the welfare of the people, the nation and the entire global community. His view encompassed economics, politics, public administration, history, anthropology, technology, management, sociology and psychology as interdependent determinants of social accomplishment.

Writing on the eve of the American Revolution in an intellectual atmosphere saturated by the idealism of freedom and equality, Smith railed against the narrow self-interest and monopolistic power of mercantilist policies, which favored some industries, businesses and classes of society over others. He exposed the inefficiency and corruption of government-authorized monopolies such as the East India Company, which the English government was forced to bail out numerous times before taking it over completely. He condemned colonialism as an exercise in vanity and advocated either the liberation of the American colonists or according them the full rights of British citizens before animosity destroyed the prospects of mutually beneficial commercial relations. He rightly predicted that America would become the world’s largest economy and the wealthiest nation on earth within a century. US industrial output grew from 0.8% of world output in 1800 to 23.6% in 1900, while Britain’s rose from 4.3 to 18.5%.4

Smith was a pragmatic advocate of free markets based on objective evidence, but he was never doctrinaire. His objective was always the welfare of the entire collective, not a belief in social Darwinism. Resigning himself to the inevitable necessity and inherent inefficiency of public administration, he praised Britain for its good governance in comparison with the other nations of Europe. His book is a remarkable record of the endless experimentation by society to arrive at the optimal blend of individual freedom and public policy. Understanding the powerful influence of business on government, he sought a mechanism to minimize this distorting influence.

Smith wrote at the dawn of the most remarkable period in human history and foresaw the gathering of social powers which were shaping the future. He perceived how the proper combination of various forms of social capital (cultural D&P) could draw upon the physical and biological endowments of earth to generate unprecedented wealth for the nations of the world. Taken together, they formed the basis for a new social organization of production and consumption with far greater capacity to meet human needs and enhance human welfare.

The technological advances of the First Industrial Revolution were primarily quantitative rather than qualitative. The tools and machines employed were extremely simple by contemporary standards and required relatively little education to build or operate. The early steam engines resembled and were based on the same principle as the common kitchen pressure-cooker. The flying weaver-shuttle involved a simple hammer mechanism to propel the shuttle to the other side of the loom. But in the latter half of the 19th century, the development of more sophisticated steam-powered ships and trains followed by the internal combustion engine and electrical power generation ushered in a qualitatively very different Second Industrial Revolution. The D&P for this new phase was human and social capital based on mental resourcefulness applied in the fields of scientific research, commercial organization and finance. Scientific developments were converted into a plethora of new products based on new industrial technologies managed by new types of publically owned and financed, multidivisional business corporations. The increasing emphasis on knowledge also created increasing demand for rapid development of human capital through expansion of the educational system to produce the increasingly diverse range of scientists, engineers, managers, technicians, marketing and investment experts needed by the new social organization.

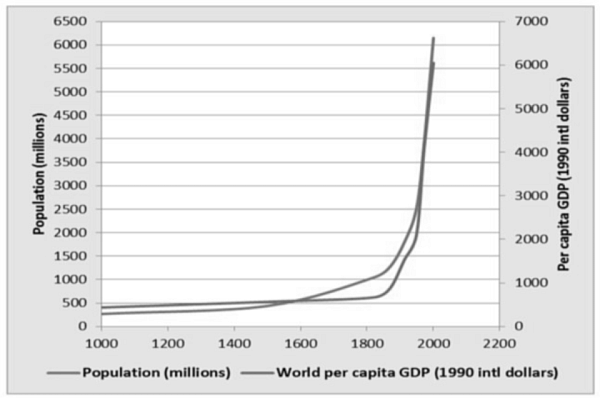

The increasing welfare and human security generated by the two industrial revolutions account for the most rapid expansion in population and living standards the world has ever witnessed, as shown in Figure 1 below. This marriage of science, technology, organization and finance reached full maturity after World War II and was primarily responsible for the 25 years of continuously high rates of growth in most industrialized and industrializing countries.

Figure 1. World Population and Per Capita GDP (PPP) from 1000 AD to 20015

4. Monetarization of Economy

The monetarization of the economy was an essential characteristic of the Industrial Revolution. Money of various types and forms has existed for thousands of years – shells, animals, corn, tobacco, copper, gold and silver were widely used in different times and places. However, until the beginning of the Industrial Revolution only a small part of economic activities involved the exchange of money. Money is one of the greatest of all human inventions. As language radically increases the capacity of human beings to communicate and interrelate, money acts as a catalytic medium to facilitate economic exchange. Its basis is some form of inherently valuable or symbolic object – wampum beads, coins, a deposit receipt for gold or some other commodity, bank notes, bills of exchange, credit cards, digital entries on a computer screen, or something even more ethereal and esoteric. But regardless of its form, the value of money arises from its general social acceptance and public confidence in the social organizations designed to issue, accept, store and regulate it. Its power is based on a system of standardized values by which all products and services can be measured on a common scale. Thus, the transition to a monetarized economy marks a major landmark in the evolution of complex social organization. The spread of money extends the reach of the social structure to encompass domains of life that previously lay beyond the organized sector.

In an agrarian society the vast bulk of production and consumption is for self-consumption and does not involve money. Agriculture thrives under conditions in which surplus production can be exchanged for other types of goods, otherwise there is little incentive for a farmer to produce more than a family can consume. Thus surplus gives rise to trade. Trade becomes organized in the form of markets, recurring physical locations or systems for the exchange of goods. Barter trade is limited by the difficulty for both buyers and sellers to find others who have something of equal value that they are willing to exchange – which depends on a double coincidence. Thus, trade gives rise to money, a medium for valuation of all products according to a common scale, which facilitates exchange over vast distances and permits storage of value over long periods of time. Trade in Renaissance Europe flourished after the adoption of Hindu Arabic numerals in the 10th century and double-entry bookkeeping in the 13th century made it far easier to calculate volumes and determine the profitability of transactions. Bills of exchange for goods traded across the continent became an important form of commercial credit, giving rise to the forerunners of modern banks. Thus, accurately minted coins established international markets, accurate accounting methods, commercial credit institutions operating on a foundation of legal rights and judicial safeguards constituting the basis for the rise of the monetarized economy.

Until the Industrial Revolution, the use of money was primarily confined to trading activities. No more than one percent of the life of an average European was organized in a monetarized system by selling their time for money or using money for trading; whereas today the average has been estimated at 16 percent or more.[†] During the feudal period, even large feudal landlords possessing thousands of acres of arable land frequently had little use for money, for there was little they could purchase in exchange for their crops. They commonly used their surplus production to feed large numbers of unproductive retainers, often a thousand or more, who endowed the lord with social status in times of peace and an army for defense or conquest in times of war. Thus, even kings and aristocrats often possessed little money, since land was the true measure of wealth.

The fact that before 1800 banking activities were often carried on by marginal groups which did not really belong to the upper classes shows that money was still regarded as a secondary tool of societal organization, rather than an integral part of the social structure. Historian Will Durant recounts an incident just before the French Revolution when the very wealthy wife of a leading Parisian banker was invited to an aristocrat’s home for a gathering of high society women. When time came to sit down for dinner, the banker’s wife was asked to eat in the kitchen. After the Revolution broke down the insurmountable barriers between birth and wealth in France, money came into its own as a premier symbol of status and a source of social power. Across the English Channel, the more pragmatic English were making an evolutionary accommodation with money. The younger sons of English aristocrats were permitted to seek their fortunes in business while many an insolvent but titled elder son condescended to marry a woman of wealth from the middle class in order to replenish the economic resources of an impoverished estate and tarnished coat of arms.

5. Evolution of Values & Power

The growth of commerce and industry had its own revolutionary effect on societal structure and power, gradually undermining the foundations of feudalism in Europe. As improvements in the rural transportation system opened up access to domestic and international markets, wealthy landlords preferred to convert farm surpluses into money to purchase Asian silk, spices and tea or American sugar, rum and tobacco. As a consequence, the population living on huge estates declined from several thousand to a few dozen. Displaced workers migrated to towns and cities in search of productive employment, foregoing the security of dependence and subordination to a wealthy master in return for the freedom to sell their labor or start their own enterprise. Those that remained on the farm gradually acquired more permanent and protected tenant rights and liberties from arbitrary authority. In both instances, a greater freedom of choice and a greater spirit of independence prevailed. Thus, monetarized trade had a powerful transformative effect on society as a whole. Commercial revolution and political revolution proceeded hand in hand.

Until Smith’s day, little recognition had been given to the role of money as a means of stimulating production. Money-lending for interest was condemned by the Catholic Church largely because it was not associated with any productive function and was equated with usury. Saving was regarded as a socially unproductive and socially reprehensible activity, which was often mocked in the classical literature as in Moliere’s play The Miser. Before the Industrial Revolution all debts were considered ‘bad’ and failure to pay one’s debts was sufficient grounds for imprisonment, as depicted in Oliver Goldsmith’s novel The Vicar of Wakefield. When Goldsmith was himself thrown in debtor’s prison, his friend Dr. Samuel Johnson discovered this manuscript at Goldsmith’s home and sold it to raise sufficient funds to release him from jail.

Smith challenged the moralistic attitudes of previous centuries, extolling the virtue of savings as the principal source of the capital required for investment to enhance the wealth and welfare of nations. The growth of trade stimulated demand for money and the need for capital accumulation. Improved rural transport opened up distant markets for agricultural surpluses, necessitating the shift from barter to a more efficient medium of exchange. Long distance sea trade in luxury goods generated increasing demand for gold and silver coinage. Until 1800 banks mainly engaged in providing commercial credit for trading activities in which investment rarely exceeded five percent of total sales. But the high cost of tools and machinery required for industrialization, which demanded increasing amounts of capital, gradually transformed banking into a highly effective social organization for collecting public savings and channeling it for productive investment in industry. Joint stock companies or corporations in which several investors shared ownership became more prevalent.

The development of new moral values and cultural attitudes paralleled the emergence of new technologies and production processes. These changes also brought about a marked change in social values and social power. As industry became an increasingly important source of national wealth and military power, the power and status of the aristocracy and the church gave way to the power and status of money. The monetarization of the economy led to the monetarization of society and politics. The Industrial Revolution became a revolution of capitalism.

Originally a symbol of economic value and purchasing power, through this process money became increasingly a symbol of social value and social power. Sacs of gold coins sufficient to purchase a rural estate or a shipload of merchandise gradually acquired the power for entry into the social elite and the halls of political power. Money conquered space, making products mobile. It became a catalyst for economic transactions. So too it abridged or eradicated social distance between the classes. It conquered time by enabling a family to acquire in a single life time the status and power once proudly accumulated by inheritance over countless generations. Money not only made products more mobile. It made social and political power more mobile and transferable. It made possible the alteration of social structures without guillotining an entire class of people, thereby facilitating peaceful social evolution in place of violent political revolution. A society capable of more rapid change exhibited a greater capacity to learn, adapt, experiment, innovate and develop.

6. Accumulating D&P

In the course of discovering a new creative power, humanity tends to lose sight of what it already knows and utilizes. We create marvellous new instruments for our advancement and then subordinate ourselves to those instruments, becoming increasingly dependent and enslaved. Thus, we have become victims of the machines we fashioned for our convenience, the laws framed to uphold our rights, the weapons we built for our defense, the markets we established to facilitate exchange, and the money we created for our collective prosperity. In the course of discovering the remarkable power of money as a form of capital, humanity has progressively lost sight of the other forms of dowry and patrimony on which the welfare and well-being of society is founded.

The environmental movement that gained momentum after the publication of Limits to Growth, a report to the Club of Rome, sought to remind us of the obvious fact that the entire edifice of our modern economy is founded on the earth’s natural and biological D&P. Accumulation of monetary capital alone cannot ensure continuous growth, indeed it will have diminishing returns and give rise to increasing problems, unless economic growth can be carried on in a manner that preserves and enhances rather than destroys and depletes the natural capital. Limits to Growth did not condemn humanity to tread water perpetually at the present stage of its collective development. Rather it announced the limits of the old industrial model of growth, to the blind pursuit of growth for growth sake, and called for a significant change in the pattern and composition of economic activity.

In fact, such a significant change in pattern was already beginning to emerge at the time of the report, but its significance was not sufficiently understood. Over the past four decades, the old industrial model of economic growth has progressively given rise to the knowledge-based service economy, with profound implications for the economic future of humanity, as we will discuss later in this article. One consequence of this development has been an increasing shift in emphasis from dependence on material D&P as the principal source of economic growth to an increasing emphasis on social and human capital, two other forms of cultural D&P capable of unlimited renewal and augmentation, which are now accumulating at an unprecedented rate. As indications of this shift, the number of students in secondary schools globally rose from 40 million to 531 million between 1950 and 2008, while the number enrolled in higher education globally rose from 29 million to 151 million between 1970 and 2008.

Accumulation is a universal phenomenon. D&P represents the global stock of asset of various forms of ‘capital’. This stock undergoes a continuous process of inter-conversion. In some instances this process enhances some forms of capital while depleting others. But its main action is to multiply the value of all forms of D&P. Thus, the application of technology to agriculture has raised the productivity of the land five, ten and, in some instances, a hundred-fold. Sand, used for millennium as a constituent for making bricks, has subsequently become a source for making glass, silicon chips and fibre optic cables. Oil, which was once burned in lamps, is now converted into high value added synthetic materials and pharmaceuticals. Human beings, once valued primarily as a source of manual labor, have been increasingly replaced by machines and are now valued far more for their social, mental and creative capacities.

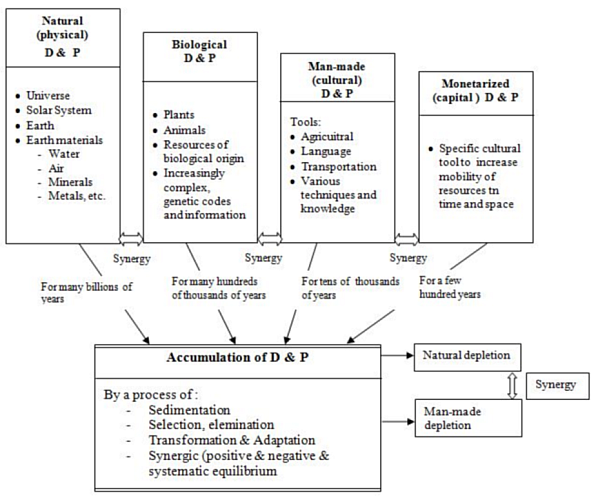

Figure 2 below depicts four main categories of capital or D&P. All forms of capital exist in a synergetic relationship as part of an evolving continuum. The interaction of these various forms exhibits an inherent capacity for self-replication or multiplication. The evolution of social organization (Cultural D&P) has given rise to an exponential growth of financial D&P. The spread of education has provided the foundation for rapid development of science, which in turn has given rise to a remarkable period of technological innovation that is still accelerating as predicted by Moore’s Law.

One type of D&P often becomes the basis for creation or development of another type. But this is not always the case. In some instances a rapid increase in one form of D&P does not necessarily reflect an overall increase in the total stock of global assets. No matter how important the monetarized economy may be, it exists and functions solely on the foundation of physical, biological, social and human capital. Exhaustion of water or non-renewable energy resources, destruction of biodiversity, social unrest resulting from rising levels of inequality, the squandering and deterioration of precious human resources due to unemployment and underemployment may co-exist for a time with rising levels of global financial assets, which have multiplied from $12 trillion to over $212 trillion over the past three decades.7 The current international financial crisis shows just how fragile and evanescent the perception of wealth may be when limited to a single measure such as money. In recent times we have witnessed the sudden disappearance of trillions of dollars of what were once thought to be hard financial assets. A failure to appreciate and respect the interdependence between these different types of assets can have far-reaching consequences, as the global impact of the 2008 international financial crisis on economic growth and employment illustrates.

Figure 2 also highlights another important attribute of economic value that is overlooked by contemporary theory. It can be either positive or negative. All that glows is not gold. All growth is not good growth. Economic activity resulting from war, environmental remediation, the rising costs associated with compensating for depletion of scarce resources reflect a deterioration in human welfare and well-being, not an enhancement, yet traditional measures of growth and national wealth regard them in the same vein as increased agricultural productivity, more housing, rising expenditure on education and healthcare.

Figure 2: Dowry and Patrimony (D & P) - The Source of Wealth and Value 6

In order for economics to evolve into a true science of wealth and welfare, new concepts are required to define with comprehensive preciseness the notion of value we seek to enhance and new measures are needed that accurately reflect the real impact of social activity on that value. A wider conception of D&P illustrates the limitations of a narrow definition of capital. But the problem extends still further into unchartered regions of social activity and potential beyond the veil.

7. The Notion of Value

It has always been recognized that a substantial part of productive activities in life and society are performed outside the monetarized context. Most classical economists from Adam Smith to John Stuart Mill devoted a considerable portion of their writings to a wider conception of productive labor and value that encompassed non-monetarized activities. Yet the very notion of value on which Smith founded his theory led in practice to the exclusion of the non-monetarized contributions to wealth creation in industrial societies. This was a logical result of his effort to focus on the means to enhance national wealth by harnessing the enormous potential of industrialization, specialization, trade and investment, rather than on efforts to measure national wealth comprehensively. He rightly perceived money as a powerful instrument of social engineering with the capacity to solve the complex logistical problems associated with industrialization. Since then economics has continued to ignore non-monetarized economic activities.

Smith’s concept of value was derived from a measurement system based on market prices resulting from the interplay of supply and demand. Price, the monetarized value of goods, seemed to be a clear, easily quantifiable yardstick to measure economic performance. The reference price of a good defined by its monetarized value had considerable advantages compared to the vaguer statements and subjective indicators of performance commonly adopted by the social sciences. An objective price was the economist’s equivalent of the speed of light or the atomic weight of atoms in Physics. It elevated Economics above the other social disciplines and brought it closer to the quantifiable precision found in the natural sciences, where phenomena are more precisely defined and more readily lend themselves to objective measurement. Thus, during the Industrial Revolution, the convenience, practicality and reference to the scientific method of analysis combined to focus attention on monetarized activities as the key tool for developing the wealth of nations.

While a focus on monetarized phenomena has proved helpful for understanding the production and utilization of manufactured goods, it is far less useful for obtaining a clear and comprehensive picture of how society evolves and how economics is being transformed in recent times by the emergence of the new service economy. Both unmonetized and non-monetarized wealth are inadequately accounted for in traditional economic theory.[‡] Today the predominance accorded to monetarized activities needs to be placed in a broader perspective. Several considerations compel us to insist on a wider conception of economic activity.

First, the monetarized and non-monetarized fields are not separate air-tight compartments. There is a continuous movement across the invisible line separating priced from free goods and services. Thus, tasks which were formerly carried out without the use of money such as mom’s cooking and housekeeping have in recent decades been shifting to the monetarized economy as more and more women seek employment and families rely on fast food and daycare services to meet their family needs. This has a double-impact on monetarized growth, since it reflects both in rising family incomes as well as rising revenues for the daycare and fast food industries. At the same time, it does not properly account for the negative impact on life styles, leisure and health arising from the consumption of fat-rich restaurant foods, higher levels of family stress and less time for exercise. Similarly, the costs of retirement have escalated due to the continued fragmentation of families resulting in a separation of the generations. When processed store-bought and restaurant foods replace home-cooked preparations, quality and value may suffer, but GDP registers an increase in wealth-creation by the food industry as well as for businesses engaged in disposal of the discarded food packaging materials. No longer is grandma so readily available to care for the kids or sons and daughters to aid their aging parents. This has generated greater freedom and independence, but it has been bought at a price in terms of quality of life, which current economic measures do not accurately reflect.

With the advent of the Industrial Revolution, money came into its own as the pre-eminent social institution. Until then, more than 50% of all economically productive activity was self-production for self-consumption or barter, i.e. it occurred without monetary exchange and remained non-monetarized. Even today money systems represent only a very limited portion of what truly characterizes the wealth of nations. Ecological resources are a good example of non-monetarized aspects of wealth. As ecologists have been emphasizing for decades, the monetarized system of measurement assigns values only according to the cost of extraction or processing. Thus, clear air and pure water may be assigned zero value; whereas when water has to be treated in order to remove impurities resulting from human activity or purchased in order to ensure health and hygiene, monetarized measures record the creation of positive new wealth. This view obscures the process by which free goods become scarce and once scarce goods become free. Is the world really “richer” today by $60 billion a year because so many people purchase bottled drinking water to avoid the risks of drinking water from the tap?

The fact that resources which were once free or available at very low cost have become an increasing cost component within the industrial production system illustrates how the monetarized economic system may create new forms of scarcity in some areas in the very process of striving to reduce scarcity in others. At the same time, technological and organizational advances can transform once scarce products and services into free goods. Access to information and many forms of communication, which were once very costly, have become virtually free. Are we not richer today for the capacity to access the world’s knowledge at our fingertips and to communicate instantaneously across the globe, even though we pay little or nothing for the privilege?

When we take full account of the complex interactions between the monetarized and non-monetarized worlds, we realize the inherent limits of the system of evaluation made prevalent by the Industrial Revolution and the underlying assumptions about wealth creation on which it is based. The increasing scarcity of ‘goods’ in the non-monetarized world may offset or even overcompensate for the decrease in scarcities in the monetarized one. The two worlds are interdependent. Clearly there is need for developing a theoretical framework as well as a system of accounting and monitoring capable of reflecting what is actually happening.

8. Beyond the Veil

There is another equally important reason for expanding our notion of value to include non-monetarized activities. As a rule new social potential first appears in the unstructured, non-monetarized sector and only gradually transitions over to the money economy. In this sense the non-monetarized sector is the birthplace and breeding ground for future progress. When Richard Sears started his mail order catalog in 1893 to cater to the needs of rural farmers who lived too far from urban centers for convenient access to goods, little did anyone realize that by 1920 the company he founded would become the largest retailer in the world, yet it still did not own or operate a single retail store. Rural America was prospering, but it lacked an appropriate delivery system to fulfill its rising aspirations. Sears’ catalog was a new form of social organization designed to monetarize this latent potential.

With the advent of mass production after World War I, the automobile began to transform American life, resulting in a rapid migration of people from urban centers to new suburban communities, which were far removed from the convenience of urban shopping center. General Robert Wood, a logistics expert who helped build the Panama Canal, learned of this trend reading the US Statistical Abstracts. When he took charge at Sears in the early 1920s, he established the first of what became known as suburban shopping centers, which he subsequently opened in suburban areas across the USA. As a consequence, Sears’ department store business expanded right through the Great Depression, a time when overall retailing in America was down by 25%. Once again Sears converted a non-monetarized potential into monetary wealth.

Social change gives rise to new needs and new opportunities which first appear in the unstructured region of non-monetarized potential. This uncharted region is not merely a finite residue left out of the national accounts. It is a creative frontier from which new opportunities are constantly emerging. Education is an example. It began millennia ago as an informal arrangement for the transference of knowledge from one person to another. In the 19th century, institutionalized public education became widely prevalent. More recently, all types and levels of education have been organized to convert them into commercial opportunities. As a consequence, the field of education has grown explosively to become a $2 trillion global industry.

Whatever its shortcomings, fast food provides a valuable service that is increasingly in demand worldwide. In the USA alone the industry expanded from $6 billion to $110 billion between 1970 and 2000, currently providing employment to about 2.7 million people. Globally it is a $200 billion industry. Similarly, the daycare industry has expanded dramatically to meet the needs of working women. In the USA, daycare is now a $35 billion industry employing 1.5 million people and the fifth largest occupation for women in America. Overall the percentage of women working in OECD rose by 55% over the past half century.

The explosive growth of microfinance globally in recent decades is an example of a social potential that remained unutilized because existing institutions were unable to find an appropriate strategy to monetarize it. As a rule, women are more reliable and responsible in managing money and repaying loans than men and they have entrepreneurial capabilities and productive talents which they are unable to express for want of effective institutional support. Since the founding of Grameen Bank thirty years ago, microfinance has grown into a global industry of more than $20 billion serving the needs of 150 million people, three-fourths of them women.

Beyond the veil of money lies the unorganized, unstructured informal fringe of society that is continuously evolving new forms and throwing up new potentials, the ever-expanding source of social creativity that is the basis for future prosperity. Google was founded as a search engine company in 1998 without any evident model for generating revenue. Two years later it introduced Adwords, an innovative system for matching the interests of searchers with the offerings of advertisers. In a decade Google built Adwords into a $28 billion business. The manufacture of material goods may have its limits, but human imagination and social innovation do not.

Furthermore, present measures of wealth fail to fully take into account the future value of investments in the non-monetarized sector. Can we really assess the value of investment in education in terms of the current cost of delivery? Such an accounting system may very well prompt us to invest in capital equipment and dispense with labor and education altogether. Measuring productivity as output per person rises when machines replace people, but what happens to the people? The carrying cost of idle plant capacity reflects badly on a company’s balance sheet, but which financial statement reflects the carrying cost of unemployed human beings and the deterioration in social stability and quality of life that result? Attempts to measure economic activity and wealth without reference to the impact on human beings can lead to surrealistic conclusions. It is dangerous. The one and only acceptable objective of economic activity is to promote welfare and well-being of all humanity.

Current systems of national accounts do not even include a balance sheet of assets and liabilities, let alone one that reflects the impact on non-monetary resources. Education is investment in the most precious of all our resources, human beings. Businesses regard capital spending on future production capacity to enhance future profits as investment rather than expenditure. Similarly, present spending on education should be accounted for as an investment in human capital to promote future wealth and welfare, as proposed by Jacobs and Šlaus in an earlier issue of Cadmus.8 Only a human-centric economic theory and system of measurement can effectively serve these objectives.

The process by which the creative potential of the non-monetarized dimensions of society is converted into wealth is yet to be fully understood. We might say that the entire monetarized economy represents an effort to structure and organize various aspects of humanity’s social existence so that they can be performed more cheaply and easily for the benefit of the collective. But this act of organization does not diminish the size or potential of the non-monetarized sector; rather it enhances it, because it progressively liberates human beings from the total preoccupation and drudgery of physical labor and material activities, so they can concentrate more of their time and energy on developing and expressing higher faculties. Freedom from drudgery provides the leisure time for thinking, exploring, discovering, interacting, inventing, innovating and creating. In the process, human beings become less physical, more social and mental; less repetitive, more creative. As the external society becomes more organized, the inner character of human beings becomes more developed and capable of expression in outer life.

During the heydays of the industrial age, the deficiencies in traditional measures of economic flow may not have undermined their essential utility. But today they raise fundamental questions which need to be addressed by new theory to evolve a more valid conception of wealth-generation and human welfare. Which blend of monetarized and non-monetized activities contributes most positively to wealth-generation and human welfare? How can we more consciously tap and organize the unstructured, non-monetarized social potential to promote greater human security, welfare and well-being?

9. The Utopia of Certainty

Ever since Man was expelled from Paradise, he has dreamed of immortal life in a utopia founded on the certainties of universal truth, where he can live fully secure from ignorance, error, death, want and from the hazardous whims of fickle Fortune. Before the Renaissance, religion was the main source of this aspiration for immortality and perfect certainty. Although the sources and imagery have changed with the passage of time, the dream lives on in the aspirations of modern science. Rapid advances in the spread of scientific knowledge, backed by a positivistic faith in science’s capacity to uncover the processes by which both physical and human events occur and the remarkable technological achievements resulting from the application of science to life and material nature, have reawakened the utopian dream in a new form. Underlying all its achievements is a belief that a scientific mastery of reality will one day come very close to universal truth.[§]

In Descartes’ time he was suspected by theologians of launching a counter-religion to replace the universal truth based on God and administered by the Church. Descartes defended the scientific method of induction by asserting that it focused only on those realities which are clearly verifiable and distinct, but the theologians perceived that the ideological and metaphysical implications of his approach could be much greater. Indeed, the words science and scientific have come to connote that which is certain beyond doubt.

Cartesianism signaled a tremendous change in cultural perspective, which was at the root of the Industrial Revolution. But it has not led to the world of certainty that 19th century scientists once anticipated and humanity still aspires for. Rather, we now realize that the further we pursue the quest for scientific knowledge, the more we discover our own ignorance and the more uncertain we become about many things we once comfortably took for granted. As Pascal said, “Science is like a ball in the universe of ignorance. The more we expand knowledge, the greater the ignorance encountered by the ball’s expanding surface.” 9 Today we measure the advance of science much more by the growing number of questions it seeks to answer than by the veracity of the answers it arrives at. Science has discovered the relativity of all our perceptions and measures of reality in space and time. It is compelled to acknowledge fundamental limits to mind’s capacity for knowledge which are inherent in nature. We may never be able to really ‘know’, but we can always ‘know’ more than before.

A positivistic conviction in our progress toward certainty was an explicit premise of the Industrial Revolution. The objective was to uncover and assemble the discrete pieces of valid knowledge needed to complete the picture of universal truth. Experience has exposed the fallacy in this view. For each attempt to frame a problem involves defining specific assumptions which may be at variance with or contradictory to previously accepted truth. Assuming that the earth was flat proved satisfactory for land-based navigation across continents, but invalid when trying to navigate the open seas. Each new discovery unfolds new layers of reality previously unknown and reveals increasingly complex relationships between the layers. Mendel’s concept of a gene proved adequate for cross-breeding of plants, but not for understanding the reproduction of chromosomes or the molecular synthesis and recombination of DNA. The microscopic behavior of molecules and atoms has proven inadequate to comprehend the behavior of subatomic particles or to reconcile them with astronomical phenomenon.

When it comes to the social sciences, the quest for certainty has proven even more elusive. While the division of knowledge into discrete subjects has enabled physical science to study material nature one layer at a time and uncover the relationships between the layers, social life represents an inextricable mixture of factors – political, social, economic, cultural, historical, geographical, demographic, psychological – which refuse to remain segregated or respect the boundaries assigned to them by the scientist. Thus, money is at once an economic, social, political, cultural and psychological power. Its value, power and behavior are the complex resultant of the interaction of all these factors.

In spite of its limitations, physical science admits of a degree of certainty which the social sciences are unable to attain. Although we cannot arrive with certainty at the precise position and velocity of an electron, we can be quite sure about its mass and charge; whereas in economics, the very notion of value is deeply problematic. The value of the most material of objects – a piece of land at Rockefeller Center in New York City, a home in Beverly Hills, an ounce of gold or a currency note – may be subject to such rapid, drastic and unpredictable fluctuations that it sometimes defies imagination, let alone prediction. The price of gold has doubled in the last two years. Between 2002 and 2008, the price of oil rose four-fold. Mass production may be able to predict with great certainty the speed with which a product can be produced, but value added measures cannot accurately predict market value or the interval before a product becomes obsolete. If we are unable to arrive at an objective value for a physical object, how much greater is the challenge to assign absolute value to wealth, welfare and progress – terms which vary widely over space and time? The utility of a fur coat or an air conditioner depends very much on the climate you live in. The value of a rare painting or priceless designer dress depends very much on who you are. Perhaps the difficulty is that we are attempting to define an inherently subjective condition in purely objective terms.

Uncertainty is a fact of life. Yet, as it presents itself to us it appears to have two apparently opposite and contradictory characteristics. On the one side, it appears to be the source of the anxiety and insecurity from which humanity progressively seeks to escape. On the other, it appears to be the source of unimagined opportunity and creative potential. Uncertainty provides the raw material for humanity’s searching, aspiring, seeking, imagining, creating, discovering, developing, inventing and innovating, the very acts which set us apart and above other species. Uncertainty is a creative cauldron out of which every new discovery and accomplishment emerges. Our efforts to limit and circumscribe uncertainty, as if it were a finite realm, are the source of humanity’s greatest achievements, as agriculture was invented to overcome the uncertainty of nature’s bounty. Diplomacy in the conference room is an effort to eliminate the destructive uncertainty of war. Law and social custom were invented to provide common rules for interactions between people. Democracy is a system intended for orderly decision-making among people with diverse interests, perspectives and values. The market is a social organization designed to efficiently match buyers and sellers in the otherwise teeming, chaotic uncertainty of commercial life.

The challenge is not to abolish uncertainty, for only death is for sure. The challenge is to find ways to creatively harness the potential of uncertainty and harvest greater security, wealth and well-being from its grasp. Historically, uncertainty has always been an undeniable fact of life – as it was during the long agrarian epoch and since the beginning of the Industry Revolution, but it assumes an even more central character and significance in the modern service economy that is emerging, which we explore in the next section.

10. Service Economy

The emergence of the modern service economy is a natural consequence of the evolution of manufacturing during the 19th century. As the production technology of the Industrial Revolution increased in complexity, the knowledge, expertise and auxiliary services required for design, development, research, manufacturing, testing, maintenance, after sales service and waste disposal increased disproportionately.

Advances in the application of scientific knowledge drove this process of increasing sophistication and complexity. Research and development strove to identify and develop ever newer, cheaper and better quality materials, machines, production processes and products. Thus, over the past century industrial and commercial research functions have grown to involve tens of millions of workers.

While the greatest challenge of the 19th century was increasing supply through higher, more efficient production, the greatest challenge of the 20th century became developing the markets capable of absorbing the increased production volumes and ensuring satisfied customers who would return to buy again. Advertising, distribution management and after sales service became crucial.

While unskilled workers could quickly learn how to perform most functions on the early assembly lines, over time the levels of worker education and skill increased enormously. This required a change in the composition in the workforce of industrial enterprises, a progressive shift from manual labor to trained technicians, engineers specialized in a wide range of subjects, systems developers and analysts, planners, financial, sales and marketing experts. A more educated, higher paid workforce also necessitated greater knowledge and specialized expertise in organizing, managing, motivating, training and developing people.

As firms grew from privately-owned and managed local businesses into regional, national and multinational, publically-owned corporations, the financial expertise needed for raising capital, managing costs, pricing products, negotiating supply and marketing contracts, taxation, dealing with banks and financial markets multiplied.

Topping off these diverse functions was the increasing need for general organizational expertise to manage, coordinate and integrate activities for procurement and production planning, inventory management, strategic planning, new business development, legal services, community, government and investor relations. While Henry Ford is credited with first applying the principles of mass production to automotive manufacture, it was Alfred Sloan at General Motors who introduced the decentralized, multidivisional organizational structure that enabled GM to lead the global automotive industry for eight decades.

The same requirement for a diverse range of specialized services arises at each level of manufacturing from raw material extraction and processing through the multiple stages of component production, subassembly and final assembly, whether carried out within a single firm or by hundreds of different firms in the supply chain.

Thus, throughout the 20th century, the functions associated with production technology (R&D, product design, quality control and manufacturing engineering), organization, human resource management, sales and marketing, and financial management became increasingly important determinates of business success and economic growth. Few of these functions were directly involved in actual manufacturing, yet all of them became essential services without which basic manufacturing could not be undertaken or sustained. In other words, as it became more sophisticated, industrial enterprises progressively transformed themselves into service organizations, which also performed manufacturing functions. Thus, we find today that the vast majority of employees in traditional manufacturing firms are engaged in performing service functions.

What occurred within industrial enterprises also occurred in the economy-at-large. A huge infrastructure of service-related social organizations emerged, specialized in countless subfields of expertise to support expanding industry – government administration, education and training, scientific research, employment, financial, marketing, legal, transportation, logistics management, communication, waste disposal, recycling, banking, insurance and financial services – until these rapidly growing service functions became the dominant driving force for the expansion of the entire economy. The development of the Service Economy is best conceived of as a global process involving the whole economy, in which service functions are integrated into all productive activities, rather than simply the growth of a tertiary sector beyond agriculture and manufacturing.

Simultaneously, the higher productivity, wealth generation and living standards resulting from the evolution of manufacturing stimulated the growth of another range of services designed to meet the growing needs and aspirations of a more prosperous population. The economy developed a second powerful engine, the engine of growing consumer demand. To meet the demands generated by higher levels of prosperity, services related to retailing, travel and tourism, communication, information, education, healthcare, banking, investment, and insurance, legal and other professional services, food and hotel services, media, entertainment, and recreation also expanded exponentially.

Our very conception of what constitutes a basic need changes as society advances. Engel’s law states that services are secondary in most cases because they fulfill only non-essential needs. Before and during the Industrial Revolution, only food, shelter and clothing were considered primary. Today that is no longer the case. Education, healthcare, financial services, computers, internet, and entertainment have become an integral part of modern life, without which it is difficult to survive socially and succeed economically. Services represent the vanguard of emerging social needs and have become essential means for promoting the wealth of nations.

The combination and convergence of these interdependent movements have given rise to the modern Service Economy which we know today. Services now account for 64% of global output and more than 70% of employment in OECD countries.10 These figures underestimate the contribution of services, since in many cases they fail to take into account service functions and employment within manufacturing industries. The cost of growing tomatoes represents only two or three percent of the sale price of a bottle of tomato sauce. The cost of producing and assembling an individual automobile represents only about 20 to 25% of its total cost. This shift to a service economy necessitates a fundamental change in the way value is measured.

11. Measuring Value in the Service Economy

At first glance it may not be apparent how or why the proliferation of service functions should alter in any fundamental way the inherent nature of economic value. But a closer examination reveals that it has profound implications for economic theory and economic measurement. The economic theory and measures of value posited by classical and neo-classical economists were based on the premise that manufacturing is the dominant source of wealth creation. The Industrial Revolution made plentiful many products that were previously either very scarce or very costly. Between the 1780s and 1860s, mechanization reduced the cost of cotton cloth to just 1% of its earlier level.

Therefore it was assumed that any augmentation of production constituted a net increase in wealth. Measuring increases in the monetary value of output, i.e. the flow of production, was regarded as an adequate measure of increasing wealth, i.e. the total stock of economic value. This assumption proved overly simplistic. It failed to take into account the depletion of physical and biological assets (D&P) that occurs during the production process. Overlooking the complex relationship between physical, biological, social, human and financial forms of D&P, it concluded that an increase in the accumulation of financial capital is synonymous with an increase in overall wealth. Some forms of economic activity, such as bottling drinking water, waste disposal and environmental clean-up represent efforts to compensate for the negative aspects of economic activity, rather than net additions to wealth. In addition, it ignored the concept of negative value or value deducted, the fact that some economic activities such as war or extracting non-renewable resource, may destroy or consume rather than generate wealth.

The growth of the modern service economy adds to these deficiencies another and more fundamental problem of measuring wealth – the problem of time. The problem arises from the difficulty in precisely assigning economic value to either a manufacturing or a service activity at the point of sale and delivery. The Industrial Revolution gave rise to measures of the increase in the economic value of the flow of production through various stages of manufacture, assuming that the production process was complete the moment a product or tool was available for sale on the market and that all costs associated with its manufacture contributed positively to wealth-creation. This assumption seemed logical and consistent at the time. Firms purchase raw materials at a given price, process them into manufactured goods, package and deliver them to customers. At that point the transaction is complete and all the costs can be known. Thus, calculating the gross national product at factor cost became a standard measure for production and wealth-generation in a monetarized, manufacturing-based economy.

12. Utilization Time & Utilization Value

Today this concept is no longer adequate. Even in manufacturing, the true cost of a product often depends on its effective performance (value) during a prolonged period of utilization. After-sales service, waste disposal and product liability have become major cost factors even for manufacturing companies, factors which cannot be accurately known at the time of production or sale. This fact was dramatically illustrated by Toyota’s worldwide recall of more than nine million vehicles in 2009-10 – equal in quantity to 90% of total light vehicle sales in the USA in 2009 – which cost the company and its dealers upwards of $4 billion, a cost which was not known and could not be reliably estimated at the time of sale.

Tracing the process back in time to the beginning of the design and production cycle, today the costs incurred in the development of manufactured products commence long before a new product ever reaches the production line, even in instances when the product is never actually produced. The costs associated with research and development, testing and prototyping can be many times greater than the direct cost of manufacturing the product. Pharmaceutical companies, for example, spend billions of dollars annually on medical research to develop new products. The average development time for a successful drug is about 12.5 years. The actual cost of materials and processing to manufacture patented prescription drugs typically represents only five percent of their final sale price. The high cost of that research also results from the fact that the cost of a great many failed research projects has to be amortized against the few successful products that emerge from R&D and come to market. Less than one in a hundred new ideas reaches clinical trials and fewer than 10 percent of these are approved for sale. Of every 250 drugs that enter preclinical testing, only one is approved by the US FDA. Thus, a true measure of value would have to take into account the entire range of costs incurred during the entire lifetime of a product prior to, during and after production.

The evolution of the Service Economy necessitates a change in the fundamental notion of value. When it comes to services, taking into account the costs incurred during the full period of utilization is still not sufficient to arrive at an accurate notion of economic value. Cost, even comprehensive and inclusive cost, is an insufficient index of real contribution to wealth. We need, instead, a wider concept that also takes into account utilization value.

Utilization value refers to the use value of the assets created (stock), rather than the notion of added value (flow). The value added measurement of mining for scarce natural resources considers only the monetarized costs of the activity (flow), but does not fully reflect the reduction in the overall stock of physical D&P associated with the consumption of an irreplaceable resource. The cost of a product does not tell us how long or how well it will serve the intended purpose. The US construction boom that resulted from easy bank credit in the middle of the last decade leading up to the subprime mortgage crisis resulted in a massive increase in the number of residential and commercial buildings, many of which have never been occupied since their construction. People were employed, materials were consumed, but has national wealth really been augmented by this activity, if the buildings themselves are never utilized? What is the true value of a computer or mobile phone or a technical education that is soon outdated and obsolete?

Common sense tells us that our real wealth and welfare depends on the use value we derive from the products and services we acquire and that this use value in turn depends on the period over which they can be utilized. This is true of products as well as services. But as we shall see, in the case of services, utilization value assumes paramount importance.

13. Valuing Uncertainty and Systemic Risk

Economic activity in the modern Service Economy is closely related to the performance of integrated systems. This is true even for manufacturing activities. Products are conceived, designed, engineered, produced, sold, serviced and disposed of by means of systems which are integrated with countless other systems within and outside the manufacturing firm – systems for research, testing, training, monitoring, communicating, transporting, warehousing, servicing, etc. The product no longer exists as a stand-alone discrete unit. It exists as part of a system, like a computer periodically in need of service. This has been true since the introduction of mass production, but it is far more important today. While the cost or value of a discrete product can be estimated at the point of sale, the cost or productivity of the system can only be measured in terms of its performance relative to the entire cycle from conception through production and delivery to final disposal.

While the industrial economy attributes value to products which exist materially and are exchanged, value in the Service Economy is highly dependent on the functioning of result-producing systems, such as systems for delivery of education and medical care. The reference for value is not to the “product” but to the utilization and usefulness of the system. Increasing productivity in the Industrial Economy is measured by the cost of the inputs used for producing products or tools; whereas attempting to measure productivity in the Service Economy by the cost of inputs without reference to specific performance is very close to nonsense. The productivity of a healthcare system depends on its capacity to cure illnesses or maintain a healthy population. The salaries of teachers or investment in school buildings cannot suffice as a proper measure of educational productivity. Assessing the productivity of an educational system needs to be based on an evaluation of the quality of learning by those who pass through it. Thus, while Industrial Economy evaluates the production of wealth in terms of added exchange value, wealth in the Service Economy is a function of utilization value.

This is evident with regard to services such as telecommunications, education, healthcare and financial services. In each of these industries, services are typically delivered over long periods and only a small portion of the cost is associated with the actual delivery of a specific service at a specific moment. The marginal cost of a single phone call is virtually zero, provided that the service depends on the existence of a massive infrastructure of telecommunications equipment, on which the investment and maintenance are nearly independent of the amount of usage. So too, the delivery of educational, medical and financial services depends on a huge infrastructure of schools, hospitals, banks, instructors, physicians, financial experts and administrative personnel. Each of these services forms part of an integrated system, linked with other social systems. In all these instances, the major cost is the cost of establishing and maintaining the system, regardless of the extent to which it is utilized. But its value, its real contribution to wealth and welfare, depends entirely on the extent of its utilization and the usefulness or quality of the service delivered.

Furthermore, in the purchase of services the buyer is primarily concerned with performance over a period of time. This is where risk and uncertainty become crucially important factors. Because a system must operate reliably over time, full evaluation of a system cannot be carried out before or at the specific time of service delivery. It can only be assessed by how the system functions in real time in the dynamics of real life. Whenever real time is taken into consideration, the degree of uncertainty and the probability become central issues. Will our mobile or internet service provider deliver reliable high speed bandwidth all hours of the day and days of the week? Can we obtain emergency services from our healthcare provider anytime and place as we may require? Does the manufacturer of our computers provide on-site service within 24 hours?