Hello Visitor! Log In

Economics as a Science – or viewed from the perspective of scientists in other fields

ARTICLE | July 12, 2020 | BY Joaquim Vergés-Jaime

Author(s)

Joaquim Vergés-Jaime

Abstract

The aim of this article is to underline that the core paradigm of mainstream economics, economics’ standard model (ESM), rests upon an explanatory theory that draws on deductive assumptions which are not supported by what observations of the reality of market economies show us; either in the present day or historically. A theoretical setting, therefore, fails to provide a proper explanation of how our economic system—a market economy based on private firms, or capitalist—operates in reality. Or that it does not explain it well for the vast majority of cases, goods, sectors or markets. I am far from being the first one to highlight this. This ‘deficiency’ of the ESM has relevant implications. It is something more than a pure theoretical issue. The fact that this explanatory model (much dominated by microeconomics) postulates that the ‘free-play market’ leads spontaneously to an optimum of social utility (a general equilibrium of efficient markets), has nevertheless implications beyond the economic discipline. In the political arena neoliberalism draws on this theoretical postulate to defend its principles of no (or minimum) intervention by governments in the economy, of no (or minimum) regulation of markets. i. e., to defend what lies behind the well-known expression ‘the less State the better’: minimum public expenditure, minimum taxes. And, furthermore, this general equilibrium model that supports such a postulate dominates the way economics is customarily taught, i.e., how the workings of a market economy is explained in textbooks and in university classrooms.

1. Economics and the Scientific Method

As a discipline or field of knowledge, Economics is clearly not an experimental science. The possibilities in this respect are extremely limited.1 When practised with scientific rigour it is in essence an observational science: we economists are confined to observing and analysing the workings of the economic system—of such and such a market economy—and thereby endeavouring to build a formal description of that in a conceptual and schematic way. A description in which a significant part refers, if not properly to ‘laws’, to patterns observed in the behaviour of individuals as ‘economic agents’—citizens, enterprises, governments, etc.,—as well as in the key magnitudes resulting from their activities and interrelations—the production of goods, employment, prices, salaries, tax collection, etc. Ideally, in addition to specifying these socially significant magnitudes and patterns in the system, this necessarily schematic description should encompass a conceptual formulation of the most relevant causal relationships between them; such as, for example, between interest rate and level of total demand of goods; or between statutory severance pay and employment level.

As in any field of knowledge, or of study, the first step in an explanatory theory of the functioning of a market economy is (or was) a previous conceptual, deductive formulation of its basic elements, and of the mentioned patterns of behaviour and interrelations. In other words, a certain general theoretical framework; a previous interpretative model based on deductive hypotheses i.e., a conceptual outline that pre-describes,—through making logical simplifications and abstractions—which are currently considered to be the essential elements of the reality under analysis: the workings of the market’s or the capitalist economic system: An initial, provisional theoretical description which allows the formulation of verifiable hypotheses and predictions about the dynamic behaviour and interrelations of these essential elements concerning the functioning of the system.

But, of course, this is, or should be, only the first step. From this stage, it is expected that this explanatory theory based on deductive assumptions be progressively revised as a result of being put to the test, confronted with the empirical observations to be gathered. Checking whether these confirm or refute—in what regard and to what extent both the general theoretical framework, axioms and hypotheses on which it is based, and the predictions derived from it.2 However, there are elements to affirm—as it is subsequently argued here that the standard model of the conventional, orthodox economics currently dominant is still largely stuck at that first step: that of purely deductive hypotheses, in the sense that they are kept unrelated to comparisons with the overwhelming empirical evidences available.

From this perspective, the essential part of the scientific method—dealing with a discipline such as Economics (or economic analysis)3—is that any given explanatory theory is good or not insofar as it succeeds in providing a satisfactory explanation of the reality in question. If reiterated observations of that reality show that such theory does not explain it well, or does not explain it in a significant number of cases, that explanatory theory must be revised or replaced by another that better fits the reality observed, the empirical evidence gathered.

The central paradigm of the orthodox or conventional economics, that is, the mainstream economics’ standard model (hereinafter ESM) can be summarised as follows: “(a) if unconstrained by interventions from public authorities, the market for each good (product or service) will spontaneously end up being a competitive and in-equilibrium market (with numerous enterprises, none of which holding market power; all selling at a price equal to their marginal cost which in turn will be equal to their average cost). This stands as a general principle (for any good in the economy), with only a few exceptions (situations of ‘natural monopoly’). And (b) if for Labour and other factors there also exist free-play markets, then the overall result of this free operation of market forces in the whole economy constitutes a social optimum of economic well-being (in terms of full use of resources, resulting basket of goods and services, and income distribution)”.

With this background, the aim of this article is to underline that this ESM paradigm rests upon an explanatory theory that draws on deductive assumptions which are not supported by what observations of the reality of market economies show us; either in the present day or historically. It is, indeed, an explanatory theory that fails to provide a proper explanation of how a market or capitalist economic system operates in reality. It does not explain the system well for the vast majority of cases, goods, sectors or markets. I am far from being the first one to highlight this.

“Modern economics is not very successful as an explanatory endeavour. This much is accepted by most serious commentators on the discipline, including many of its most prominent (See, for example, Rubinstein 1995:12; Lipsey 2001: 173; Friedman 1999: 137; Coase 1999:2; Leontief 1982:104. (...)”

(Tony Lawson, “Modern Economics: the Problem and a Solution”, in Fullbrook 2004: 21)

(Note that, probably not by chance, the last three authors cited by Lawson in the paragraph above are Nobel Prize laureates in Economics).

That deficiency of the ESM has relevant implications. It is something more than a pure theoretical issue. The fact that this explanatory model of the academically mainstream economics (much dominated by microeconomics)4 postulates that the ‘free-play market’ leads spontaneously to an optimum of social utility (a general equilibrium of efficient markets),5 has nevertheless implications beyond the economic discipline. In the political arena neoliberalism draws on this postulate to defend its principles of no (or minimum) intervention by governments in the economy, of no (or minimum) regulation of markets,

i.e., to defend what lies behind the well-known expression ‘the less State the better’: minimum public expenditure, minimum taxes.

And, of course, the general equilibrium model that supports such a postulate dominates the way economics is taught, how the workings of a market economy is explained in textbooks and in university classrooms: Conveying to readers and students a theoretical description, a set of explanatory axioms, which do not actually fit in, regarding fundamental elements, with the economic reality of our societies; a theoretical model which rather refers to an imagined market economy. In this regard, the use of certain typical concepts, such as ‘imperfect information’, ‘economics of imperfect competition’, or ‘market imperfections,’ by mainstream neoclassical economists, to refer to features which in fact are normal and central to our market economies is quite significant. Scientific colleagues in other fields—including other fields of social sciences—often find it funny that we economists consider the economic reality to be imperfect because it is bent on disagreeing with the description that the standard theoretical model in economics postulates.

But in any case, this is the theoretical paradigm that in general the economists who advise, recommend or decide on economic policy measures (of governments as well as international organisations) have learned—and often also taught. And to the extent that such paradigm does not match the reality of how our economies function (regarding fundamental matters, not in-detail aspects), the economic policy measures that these professional economists design or apply taking such a paradigm as reference framework have a high risk of being wrong, useless or counterproductive for the collective wellbeing. In the same sense that an anatomy & physiology that would not describe well the functioning of a particular organism could lead to incorrect predictions or wrong diagnoses, and consequently to useless or counterproductive treatments or recommendations.

Thus, insofar as the ESM is a theoretical framework that does not describe/explain well the reality of the workings of our market economies—starting with the behaviour patterns of the different economic agents (enterprises, consumers, investors, banks, employees, executives, etc.) or explains it in a distorted manner, it easily leads to wrong deductions or diagnoses, or to a lack of realistic predictions. As dramatically highlighted by the global financial crisis that started in 2008 in the US when the finance/real estate bubble ‘burst’. Something that the most influential economists had not considered possible at the time, simply because—according to the assumptions of the models on which they were based (‘markets self-regulate’; ‘investors assess risks perfectly, in their own self-interest’)—such a thing could not happen.6

In order to confront the assumptions, axioms and propositions of the ESM with the respective empirical evidences, it is appropriate to begin by highlighting a core issue: The basis of the ESM is apparently aseptically ‘technical’. It is specifically a deductive theory as to how companies work and behave, how their costs for a good vary with respect to its level of production, the way its sale price comes determined, and, as a result, affects the structure of the corresponding market. This is a deductive theory (the ‘neoclassical theory of production’) which, I will argue, is clearly unrealistic. Among other things, but as a core piece, this theory assumes that in the production of any good (by any undertaking), economies of scale become exhausted for very small volumes of production compared to the size of the total demand to be covered for the referred good; and that this general appearance of decreasing returns to scale prevents companies from growing ‘too much’, and thus from achieving market power; and therefore that ‘without the need for any regulation from public authorities, the market of any good tends to be perfectly competitive, efficient, and in equilibrium’.

With a view on that, what follows focuses on highlighting that such mainstream deductive paradigm regarding how the economic world of production, enterprises and markets works does not come supported by the overwhelming empirical evidences provided by observing the workings of our real market economies. And it does not respond to these observational evidences from real life, not in terms of detail but in terms of fundamental and key issues.

2. Implicit Deductive Assumptions of ESM

The aforementioned postulate on decreasing returns as a sort of general law in the economic world rests in fact upon assumptions that however are usually left implicit. If we make them explicit, the summary could be as follows:

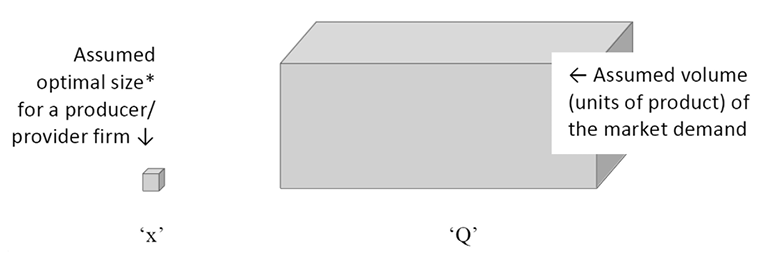

- The deductive assumption – since it is not presented in textbooks as deriving from the systematic observation of real cases, rather it is simply assumed implicitly, like an axiom—that “for the production of any good, in the long run a comparatively small firm gets a lower average cost as it grows in size, and so producing larger quantities (=increasing returns to scale). But this is only the case up to a specific dimension. From this point (volume of units) on, there appears decreasing returns to scale: the unit cost begins to increase. That is, there exists, for the firm, a given dimension, size, structure (associated to produce ‘x’ units of the good) at which the unit cost is the minimum possible one. Consequently, all firms engaged in the production of that good tend to adopt this dimension: The one associated with the optimal scale of production, ‘x’ units of product*, because it allows each of them to operate with the (same) minimum average cost.”

- the auxiliary hypothesis—also usually implicit—that the market demand for the good in question—for a price close to the firms’ unit cost—Q units, is—with rare exceptions (natural monopolies)—many times greater than the optimal sale of production for a firm (‘x’ units).

Certainly, from this deductive assumption (I) on the world of costs and firms, and this auxiliary hypothesis (II) on the relative size of market demand for each good—along with other assumptions, like that any (private) undertaking operates with full productive efficiency—the theoretical proposition follows that “without any public intervention, the market for any good (product or service) will end up having ‘a great number’ of firms supplying it; (as many as Q/x). All of them being as clones: the same technology, size (that associated with producing ‘x’ units) and efficiency; and, therefore, the same unit cost. All of this automatically giving way to full competition in this market (a perfectly competitive market). And so for any good, with some exceptions (situations of natural monopoly).

This is in fact the core postulate of the neoclassical ‘theory of production’—which in turn constitutes the nucleus of the core model of mainstream economics: the General equilibrium of Competitive Markets. A model that can also be considered as an elegant way of formally expressing Adam Smith’s metaphor of the invisible hand—by means of adding more assumptions to it and expressing it in mathematical terms. In the words of Philip Klein:

“A consensus presentation today of the central thrust of microeconomic theory, all derived from a vast elaboration of Smith’s invisible hand, might run as follows. If we assume pure competition (that is, we consider many buyers and sellers, each too small to affect market price) of homogeneous products and assume as well that competition is perfect (resources are mobile, all agents have perfect knowledge of all alternatives available to them) then we can consider fairly completely the normative implications (of the standard model).” (Klein 2006: 20).

In addition to the aforementioned nucleus—assumptions (I) and (II)—the ESM also rests on other assumptions that are presented as mere simplifications. Two of these are key in the whole picture: first, that “there is no inequality in income and wealth distribution in society”; second, “the labour market is free (unregulated); and (therefore) there is full employment”. Though, indeed, these7 may be regarded rather as oversimplifications, since they inevitably condition the realism of the model’s deductions. To these assumptions/oversimplifications there must be added other simplifications; such as “there are no externalities (those non-monetary costs and benefits, generated by economic activities without being reflected by markets)”; that “a firm produces only one product/service”; that “these are homogenous, not-differentiable in the eyes of potential buyers (in terms of quality, variants, performances, etc.)”; and that “there is no foreign trade”.

“David Ricardo completely ignores the presence of increasing returns, and it is Ricardo more than any other single individual who has set the tone of modern economics.” – Kenneth Arrow

Any non-economist with some experience in the business world will probably be surprised by this mainstream theory describing the workings of our market economies based on private or, if preferred, capitalist enterprises. To start with, the aforementioned deductive assumption (I) that there is a ‘natural’ economic ceiling to the size of any firm, ‘beyond which it is not interested in growing because its unit cost would soar’. To a non-economist it will be obvious that this assumption does not generally correspond to the business and market realities that can easily be observed. In fact, the dominant picture we can see in the real business world is quite the opposite: companies having a tendency to sell as much as possible, to increase their level of activity (structure, production, sales), and to grow as much as they can, precisely as a way of increasing their competitiveness (lower unit costs) and/or market share (i.e. market power)—in order so to increase or maintain their profits.

3. The Unrealism of the decreasing-returns-to-scale Assumption

In any case, the extensive generic evidences provided by the observation of the economic and business world shows us, in addition to the aforementioned tendency of firms to grow—that the most general pattern of the relationship between unit cost and a firm’s scale of operation (size) is that: the average cost of a good tends to be indefinitely constant (or somewhat decreasing) from a certain volume of production/size (optimal minimum scale). This scale or firm size depends on the good in question and on the technological possibilities and factors’ prices at the time.

In other words, what it shows to be more common in reality is a situation of constant (or increasing) returns to scale for ever-increasing volumes of production, rather than decreasing returns to scale. And, consequently, there is a tendency for producer companies to grow in size—and so in market share.

It will not be too surprising that this unrealism of the traditional ‘decreasing returns’ assumption (i.e., rising average cost) had been repeatedly ‘denounced’ by some leading economists; who also pointed to the obvious, and predominant, real cases that show quite the opposite: companies producing a good under increasing returns conditions: with a lower unit-cost as the volume of units increases. Although he was not the first to do so, Piero Sraffa already highlighted the unrealism of the deductive assumption on the emergence of decreasing returns beyond a certain (comparative small) volume of production/size of a company:

“Everyday experience shows that a very large number of undertakings and the majority of those which produce manufactured consumers’ goods work under conditions of individual diminishing costs. Almost any producer of such goods, if he could rely upon the market in which he sells his products being prepared to take any quantity of them from him at the current price, without any trouble on his part except that of producing them, would extend his business enormously. (Sraffa, 1926: 543).”

And some paragraphs later, (when he refers to the neoclassical theory’s assumption of a ‘U’-shaped behaviour for the long-run average cost function),

“Business men, (…) would consider absurd the assertion that the limit to their production is to be found in the internal conditions of production in their firm”

In the same vein we can cite, for example, Blaug (1968: 465-6; 1985; 456-7). As well as Lancaster (1981:200), when he points to the obvious fact of the possibility, for any firm producing a given good, to decide double, triple,…, replicate the corresponding optimal-efficient plant-size. That is, the pure logic of (at least) constant returns, rather than decreasing returns, given the obvious possibility of the replicability-within-a-firm. In other words, it is a matter of not confusing “production unit or plant” with “firm”. Something that had already been pointed out by Bekestein (1975) in his more specific work on the matter: the factual evidence on the replicability, within a firm, of the corresponding, optimal (cost-efficient) production unit. An evidence he illustrated with the concept of “multi-plant firm”.

Cohen is another academic who continued Sraffa’s claim, by insisting on the overwhelming evidence on the matter; and in particular by asking why such evidence was still not considered by leading academics in mainstream economic theory. His answer: Because admitting such evidence invalidates the model of perfect competition and general equilibrium held by that economic theory:

“These auxiliary assumptions (of diminishing marginal returns in the short run and decreasing returns to scale in the long run) provide (to the neoclassical theory) a basis for questioning and discounting empirical evidence of non-increasing costs and thereby retaining the theory.’ (…) The theory of the cost conditions of the firms was derived from the conditions necessary for equilibrium in a perfectly competitive industry rather than being derived from historical observation of firms. It is this procedure that accounts for both the empirical inconsistency of the theory and why it cannot be sacrificed without sacrificing the more general theoretical framework of equilibrium economics.” (Cohen, 1983: 218); (italics mine).

“The reason the Ricardian assumption of decreasing returns remains valid is probably because this assumption is needed in ESM to postulate an automatism toward competitive markets.”

Mansfield, on the other hand, sums up the inconsistency of the ESM regarding empirical evidences as follows:

“(an) interesting conclusion of the empirical studies is that (...) (in) the long-run average cost function in most industries seems to be L-shaped… not U-shaped. That is, there is no evidence that it turns upward, rather than remaining horizontal, at high output levels (in the range of observed data)’ (1994: 242)”

Furthermore, the authors of the popular textbook on industrial economics, Economics of Industrial Organisation, Williams Shepherd and Joanna Shepherd, note in their text—when analyzing the empirical observations available—the non-evidence of decreasing returns to scale for firms. And they also underline what they consider to be the surprising, repeated and old ignorance of this reality in the ESM field, in economics in general and in most microeconomics texts in particular (Shepherd & Shepherd, 2004, 5th Ed.; 162-6). Philip Klein has also argued himself in the same vein in his 2006 work (Klein, 2006: 27-9).

And in some way so did even Arrow himself—who along with Debreu (also a Nobel laureate, in 1983) brought the mathematical rigor of the general equilibrium model, and the assumptions required by that, to its highest level—when he asserted,

“ .. (to) deplore the failure of David Ricardo and his mainline successors to grasp this important aspect of Smith’s thought. (..). David Ricardo completely ignores the presence of increasing returns, and it is Ricardo more than any other single individual who has set the tone of modern economics.” (..)

“It was Cournot (1838) who first explicitly classified the laws of returns. He was primarily interested in the effects of returns on pricing and output, the theory of value as we may say. One hundred and sixty years later, not a great deal has been added to Cournot’s work, which, along with Mill’s, was the main source for Alfred Marshall’s synthesis. There are many individual observations of great importance in Marshall’s work, many more than in Cournot or Mill, but the increasing returns passages remain isolated from Marshall’s central core of competitive equilibrium theory.” (Arrow, 2000: 172) ; (italics mine).

Nonetheless, it is the traditional ‘ricardian’ assumption of decreasing returns to scale in the long run (i.e., increasing unit cost) that continues to dominate the academic/professional landscape in economics. In spite of it being an untenable assumption given the overwhelming empirical evidence about. The reason it remains valid despite everything is probably because (as Cohen points out in the paragraph cited above) this assumption is needed in the ESM in order to postulate an automatism toward competitive markets. Certainly, the theoretical assumption of decreasing returns (in the production of any good, from a comparatively small volume-of-units/size-of-firm, relative to the size of the demand for the good) is a key piece to then postulate the general equilibrium of competitive markets. By way of example:

“.. in the case of decreasing cost industries, no long run competitive equilibrium can exist …”, (Mas-Colell et al., 1995: 336);

“.. if the efficient scale of operation is large relative to the size of market demand, it could well turn out that the equilibrium number of active firms is small. In these cases, we may reasonably question the appropriateness of the price taking assumption ..” (ibid.: 338).

To which we might add that those cases the above quotation refers to are not (as implicitly suggests) a kind of particular, minority situation in the real economic world but rather the general pattern in it.

4. Conclusions

The unrealism of the traditional deductive assumptions implied in the ESM—to underpin its thesis that business growth will be constrained by the inevitable emergence of decreasing returns to scale—is obvious. However, such a theory, the so-called “U-shaped” hypothesis (referring to the diagram used in textbooks to represent the long-run average cost in relation to the volume of units—for any good), remains the dominant element in academic texts and most reference textbooks. Or, as noted above, it is the hypothesis that is adopted in standard economic theory (basically, microeconomics) to formalize mathematically the “general equilibrium of competitive markets” and the thesis and postulates derived from it.

What is the likely explanation for this? In spite of its unrealism, this “decreasing returns” hypothesis and its mathematical formulation is necessary to sustain the equations-system model of the ‘general equilibrium of competitive markets’; and thus to give way to postulates such as “a free-market economy will necessarily lead to the overall situation of many firms competing for each product or service; thereby achieving a general equilibrium, which is socially optimal in terms of economic welfare.”

In the same way ESM also requires the auxiliary hypothesis (usually implicit, like an axiom) that “the normal case is that the volume of units (x) that allows any enterprise to produce a given good at the lowest possible average cost, is many times lower than the volume of units (Q) that the market demands for that good”. Without both these unrealistic assumptions, the deduction on automatism toward competitive markets and the mathematical model of the general equilibrium of mainstream economics cannot be sustained. No one can sustain the normative economic policy message all of that conveys: that “it is better not to regulate markets, since they self-regulate, thanks to the strong (‘perfect’) competition that the free-play market automatically generates; and that this also makes the price for a product equal to its marginal cost, which in turn—given that private firms are perfectly cost-efficient—matches the respective average cost. So that, in equilibrium, firms’ profits are null (sic); etc.”

“Key assumptions underpinning ESM should be rejected on the grounds of the overwhelming empirical observations, and therefore we should proceed by revising or rejecting the model accordingly.”

To look at the matter from another angle, ESM—considered as a theory to explain the essential elements and overall workings of the economic system, our market economies—does not actually explain the system or does not explain it well. And not just regarding technical specificities or secondary details but regarding fundamental issues of the real economic world.

Following the scientific method, it is the accumulation of observations about economic reality—the patterns of behaviour of people and groups as economic agents, as well as of the relevant quantitative variables—which allow us to refine, reformulate or change the initial hypotheses. Empirical observations are fundamental to draw inferences or inductive propositions on the regularities that define the reality under analysis. And thus allows to revise and improve the previous theory; so giving way to a better, useful explanatory scheme, or theoretical model, of that part of the reality: the workings of a market economy based on private firms.

From this overview, key assumptions underpinning ESM should be rejected on the grounds of the overwhelming empirical observations, and therefore we should proceed by revising or rejecting the model accordingly.

There is no doubt that, in terms of the scientific method, a formal explanatory scheme on how market economies work will never be perfect. Among other things because we are dealing with a reality where the patterns, ingredients and structures of which may change over time. However, there is a broad spectrum between imperfection and misrepresentation. And, certainly distorted ideas of a given social reality—whether as a result of insufficient knowledge, the misapplication of knowledge, or some other cause—can easily lead to flawed, if not counterproductive, collective decisions, policies and practices. And if such distorted ideas are imparted as the standard academic description, in textbooks, classrooms and texts by the respective professionals, the problem grows, with implications. Something that is particularly relevant in the social sciences fields today.

- Arrow, K. J. (2000) “Increasing returns: historiographic issues and path dependence”, The European Journal of the History of Economic Thought; 72:2, 171-180.

- Beckenstein, A. R. (1975) “Scale Economies in the Multiplant Firm: Theory and Empirical Evidence”, The Bell Journal of Economics, Vol. 6, No. 2, pp. 644-657.

- Blaug, Mark (1968), Economic Theory in Retrospect, (1st. ed., revised), and (1985, 4th ed.) Cambridge University Press.

- Cohen, A. J. (1983) “The laws of returns under competitive conditions: progress in microeconomics since Sraffa (1926)?”, Eastern Economic Journal, 9(3): 213–20.

- Cohen, A. J. (1996) “Why haven’t introductory textbooks resolved Sraffa’s 1926 complaints?”, in N. Aslanbeigui and M. I. Naples (eds), Rethinking Economic Principles: Critical essays on introductory textbooks, Chicago, IL: Irwin, pp. 81–91

- Fullbrook, Edward (2004), A Guide to What’s Wrong with Economics, Anthem Press.

- Klein, Philip A. (2006), Economics Confronts the Economy, Edward Elgar

- Lancaster, K., (1981), Economía Moderna 1, Alianza Editorial

- Mansfield, Edward (1994), Microeconomics: theory & applications (8th. edition), W. W. Norton8

- Mas-Colell, A., Whinston, M. D. and Green, J. R. (1995), Microeconomic Theory, Oxford University Press.

- Shepherd, W. G. and J. M. Shepherd (2004), The Economics of Industrial Organization, 5th edn, Long Grove, IL: Waveland Press.

- Sraffa, P. (1926) ‘The laws of returns under competitive conditions’, Economic Journal, 36(4): 535–50.

Notes

- Basically, laboratory experiments, with small groups of individuals who are presented with designed decisions that involve receiving more or less money.

- We might draw a parallel between the application of the scientific method to explain the workings of market or capitalist economies—the ideal foundation of Economics as an academic discipline— and the disciplines of Anatomy and Physiology; of the human species, for example. Though with a significant difference: while in physiology we can observe certain stable regularities or ‘laws’ (for instance, how a particular type of fat is metabolised), economies are dynamic systems, where regularities or patterns are liable to change over time. This is partially because these patterns are in fact made up of (or determined by) socio-political decisions regarding what is collectively deemed appropriate or not (laws, regulations, etc.). And partly due to ‘autonomous’ dynamics, such as technological or demographic changes, changes in the average level of knowledge, in tastes/ & preferences, and in the level of collective wealth (level of development).

- ‘Economic Analysis’ is a term used increasingly by contemporary theoretical economists to refer to their academic activity.

- For most academic mainstream theorists, microeconomics is in fact the basic component of modern, neoclassical, mathematical, orthodox economics (microfoundations of economics is the standard expression to refer to that)

- Optimum which, in short, is defined in the theory of general equilibrium of competitive efficient markets (GE) as a situation in which the resources available in the considered economy (a country) are fully and efficiently used to produce what is demanded by the citizens, who then pay a price equal to the respective unit-cost for every product and service. i.e., it is assumed that the private companies of a market or capitalist economy do not earn any profit (sic).

- Let us take into account that these models are based on premises or assumptions that every market (the real estate market, the financial market, etc.) is ‘by nature’ efficient, it self-regulates, and spontaneously tends towards an equilibrium. In turn, this draws on the assumption that those who make the decisions in all markets are ‘agents’ who act with pure economic rationality, seeking to maximise their profits or utility in the medium and long term; and therefore they have incentives to be ‘perfectly’ informed, to assess the current and future financial risks—of any operation, investment, etc.—‘perfectly’ before deciding on them; and so on.

- Together with others; like ‘perfect information’, ‘no-entry-barriers’ for anybody producing any good, and ‘homo-economicus behaviour’.